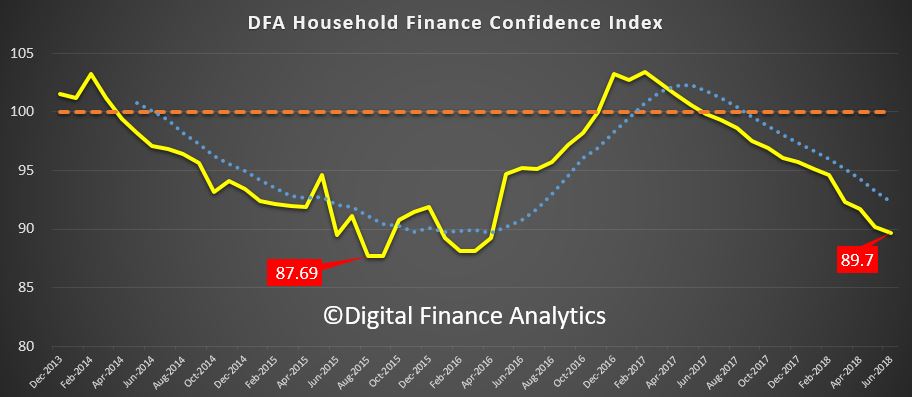

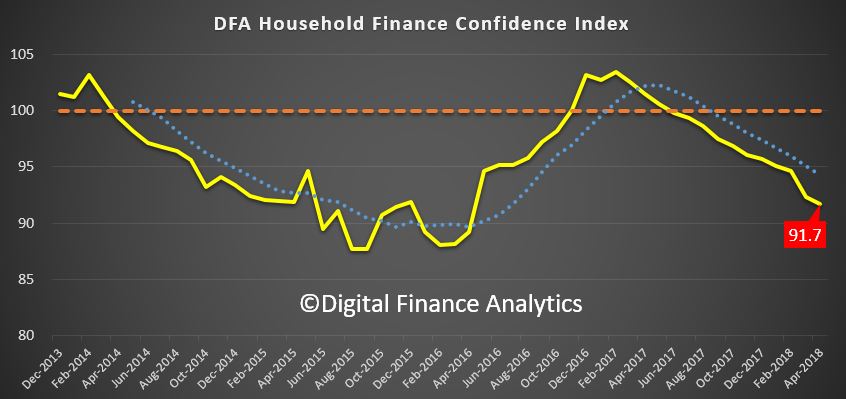

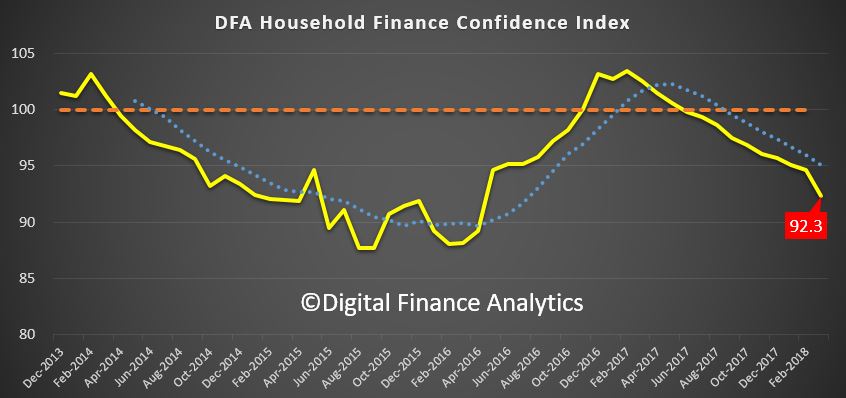

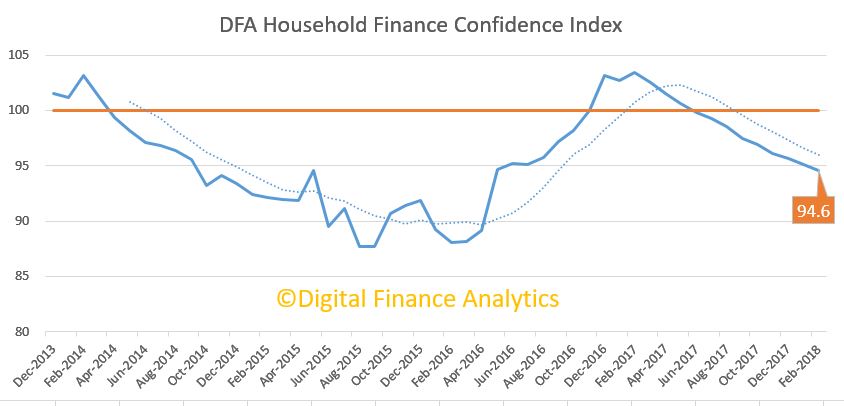

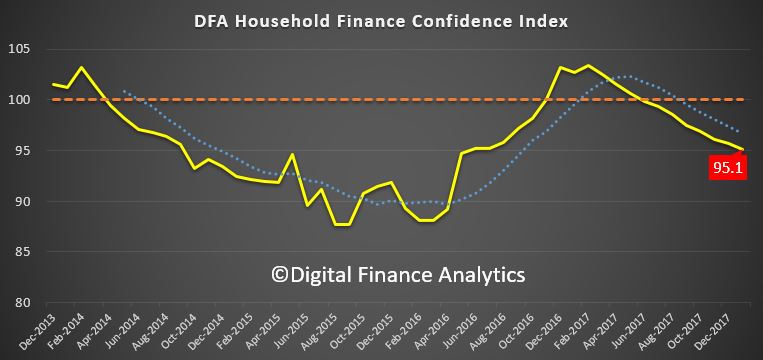

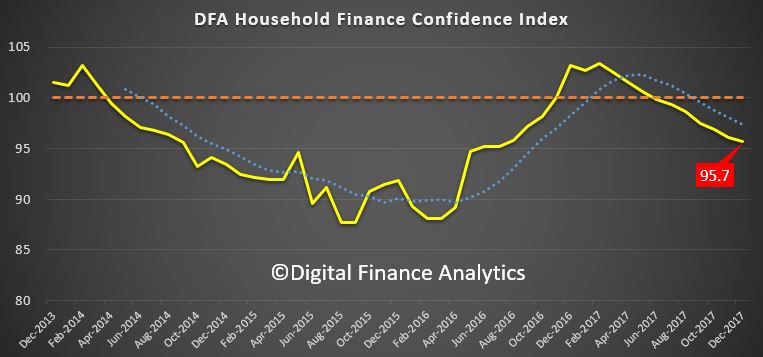

We have released the June 2018 edition of our household financial confidence index, which draws information from our rolling household surveys. In June the overall index fell once again to 89.7, well below the 100 neutral setting down from 90.2 last month.

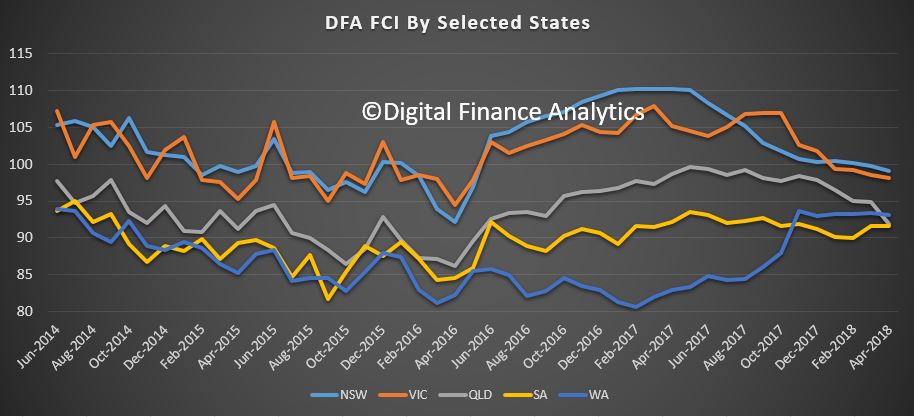

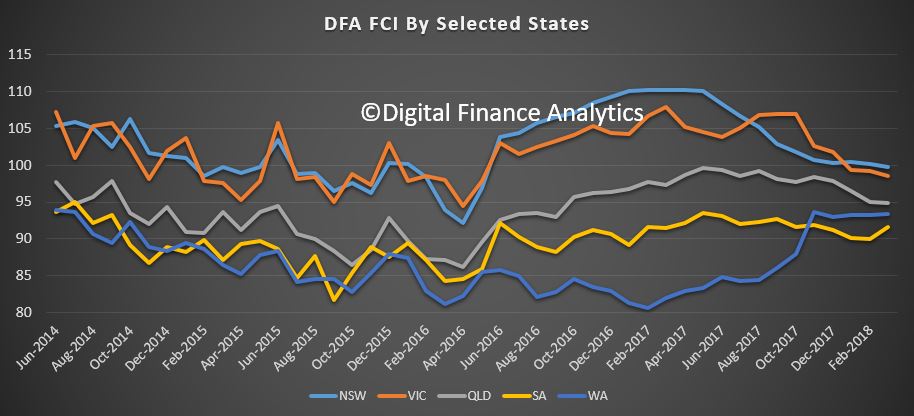

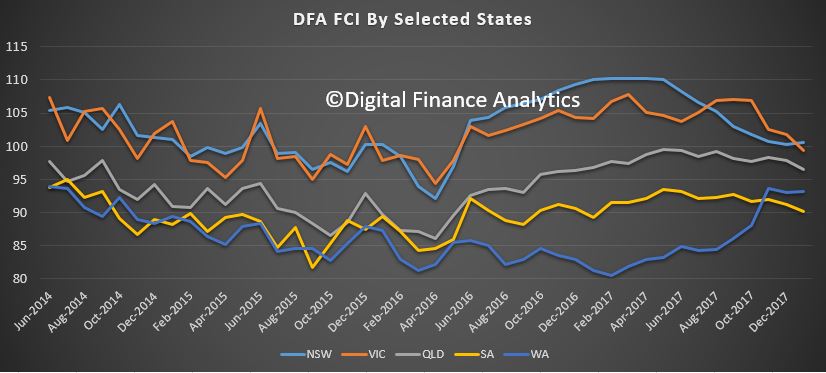

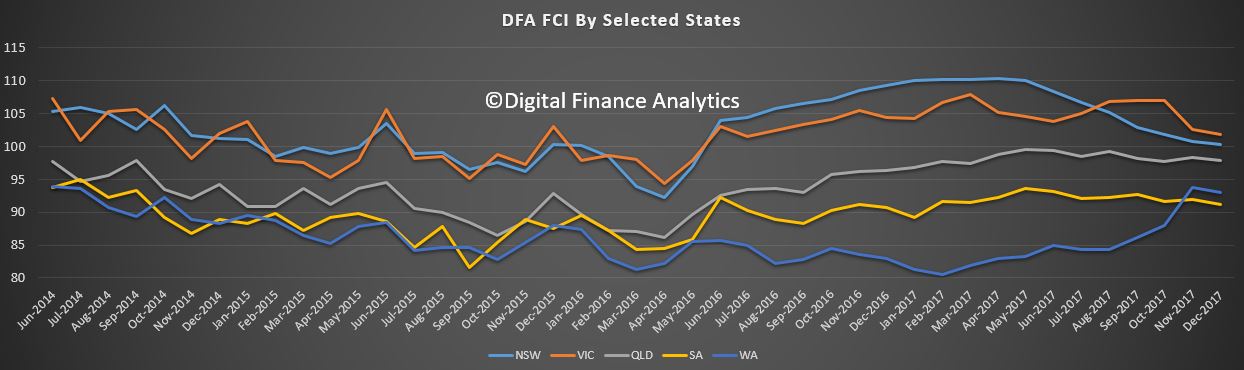

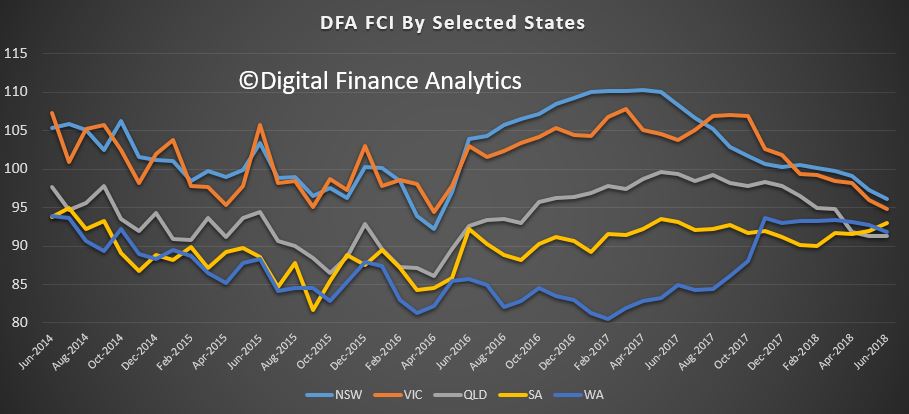

Looking at the results across the states, we see further falls in New South Wales and Victoria, a small fall in Western Australia, but small rises in Queensland and South Australia.

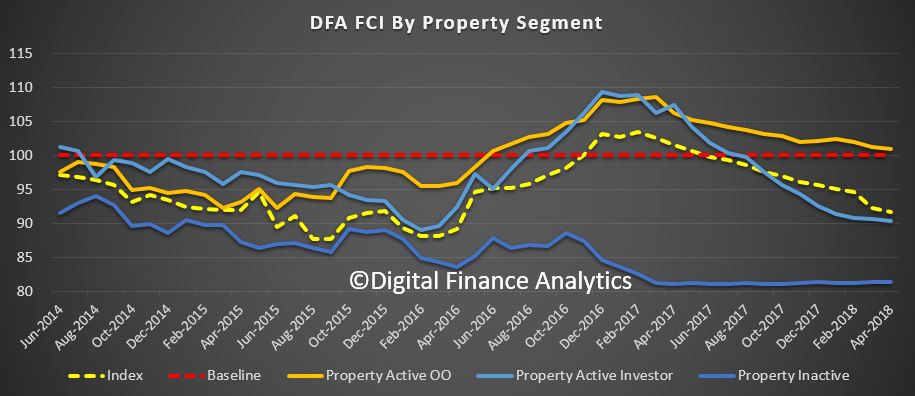

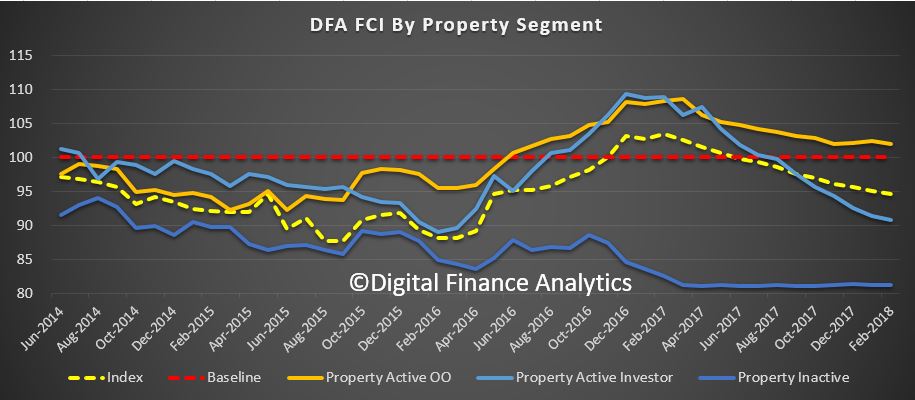

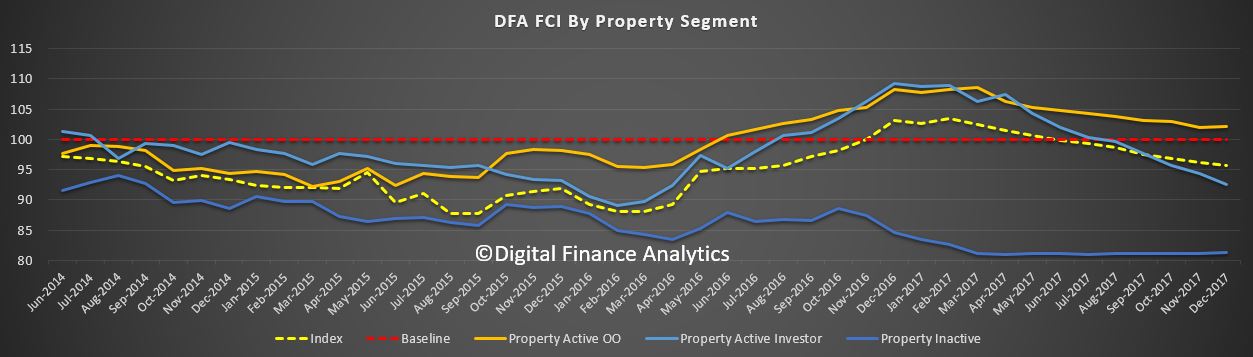

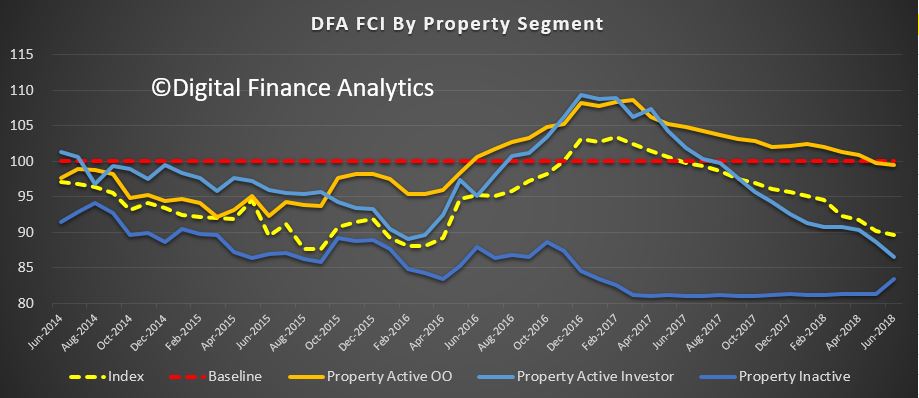

Looking across our property segments, those who are renting or living with families or friends returned a small rise, reflecting expected tax changes and increments on some wages for the new financial year. However, those owning or investing in property were significantly less bullish (drowning out any benefit from the tax changes etc.). Property Investors are getting very nervous as prices decline, interest rates are expected to rise, and rental streams are crimped. We noted a rise in vacancy rates in a number of areas. Owner occupied (OO) households are more positive, relatively speaking, although they have dipped below the neutral setting in April.

Looking across our property segments, those who are renting or living with families or friends returned a small rise, reflecting expected tax changes and increments on some wages for the new financial year. However, those owning or investing in property were significantly less bullish (drowning out any benefit from the tax changes etc.). Property Investors are getting very nervous as prices decline, interest rates are expected to rise, and rental streams are crimped. We noted a rise in vacancy rates in a number of areas. Owner occupied (OO) households are more positive, relatively speaking, although they have dipped below the neutral setting in April.

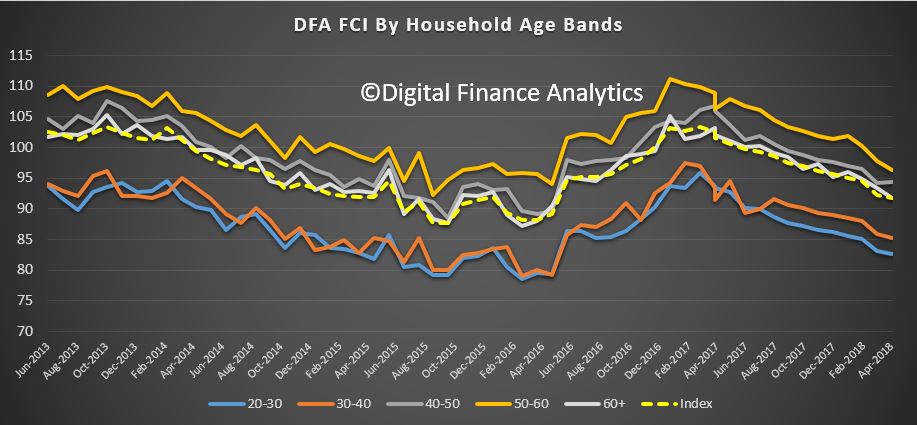

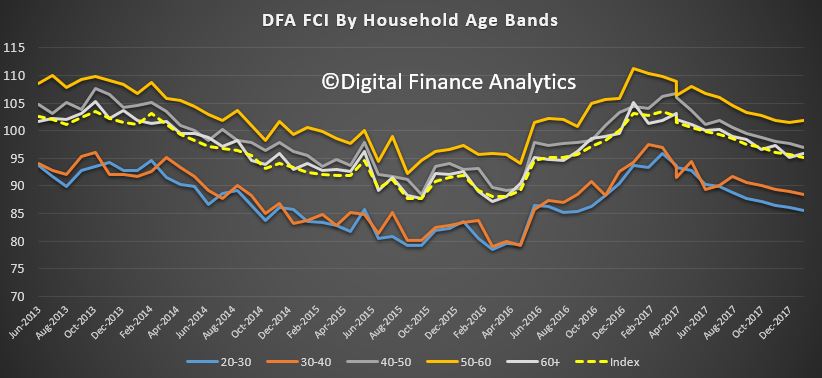

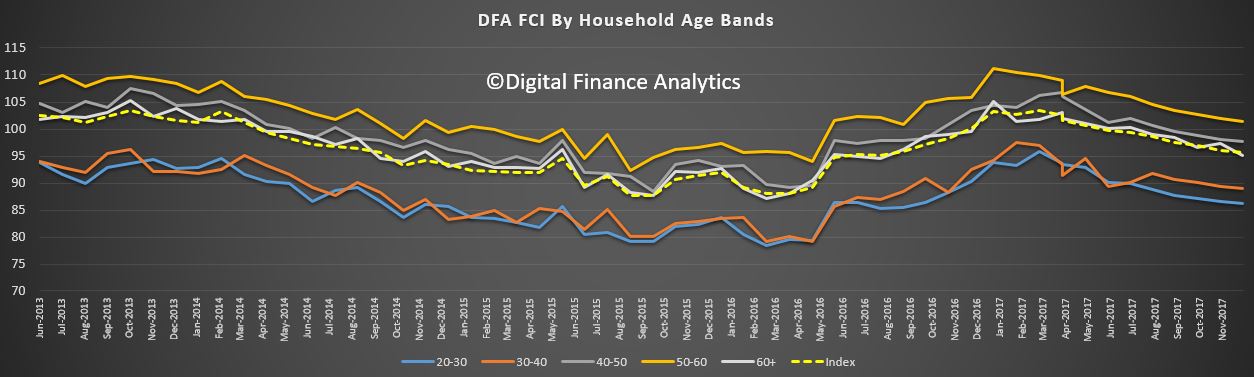

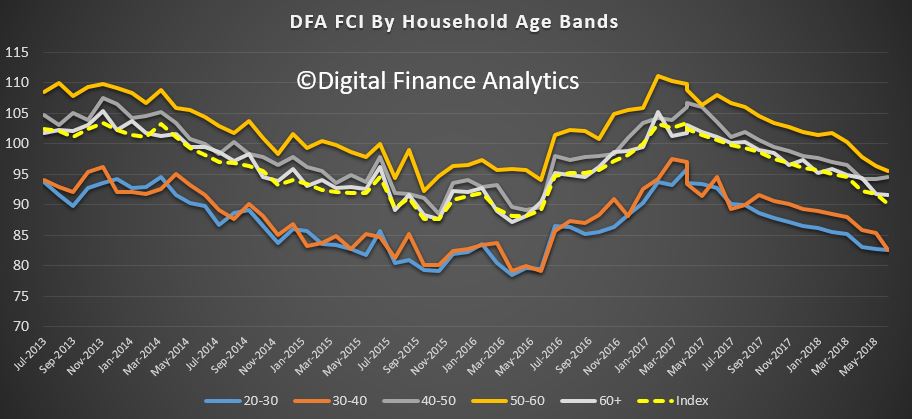

Across the age bands, older households are more bullish, with those over 60 years and 50-60 years a little more positive on the back of the recent tax changes from 1 July 2018. On the other hand, younger households are consistently less positive, especially those who purchased property in the past couple of years. Those aged thirty to forty years are under most pressure. Those with savings in the banks remain concerned.

Across the age bands, older households are more bullish, with those over 60 years and 50-60 years a little more positive on the back of the recent tax changes from 1 July 2018. On the other hand, younger households are consistently less positive, especially those who purchased property in the past couple of years. Those aged thirty to forty years are under most pressure. Those with savings in the banks remain concerned.

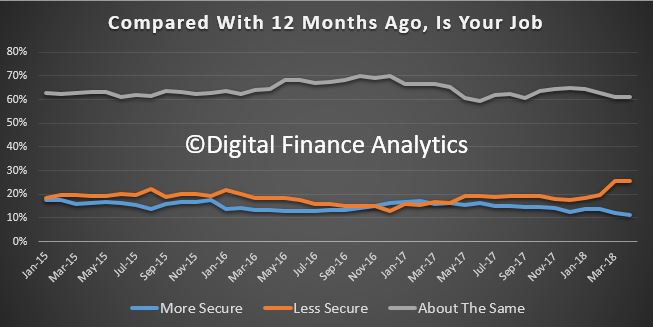

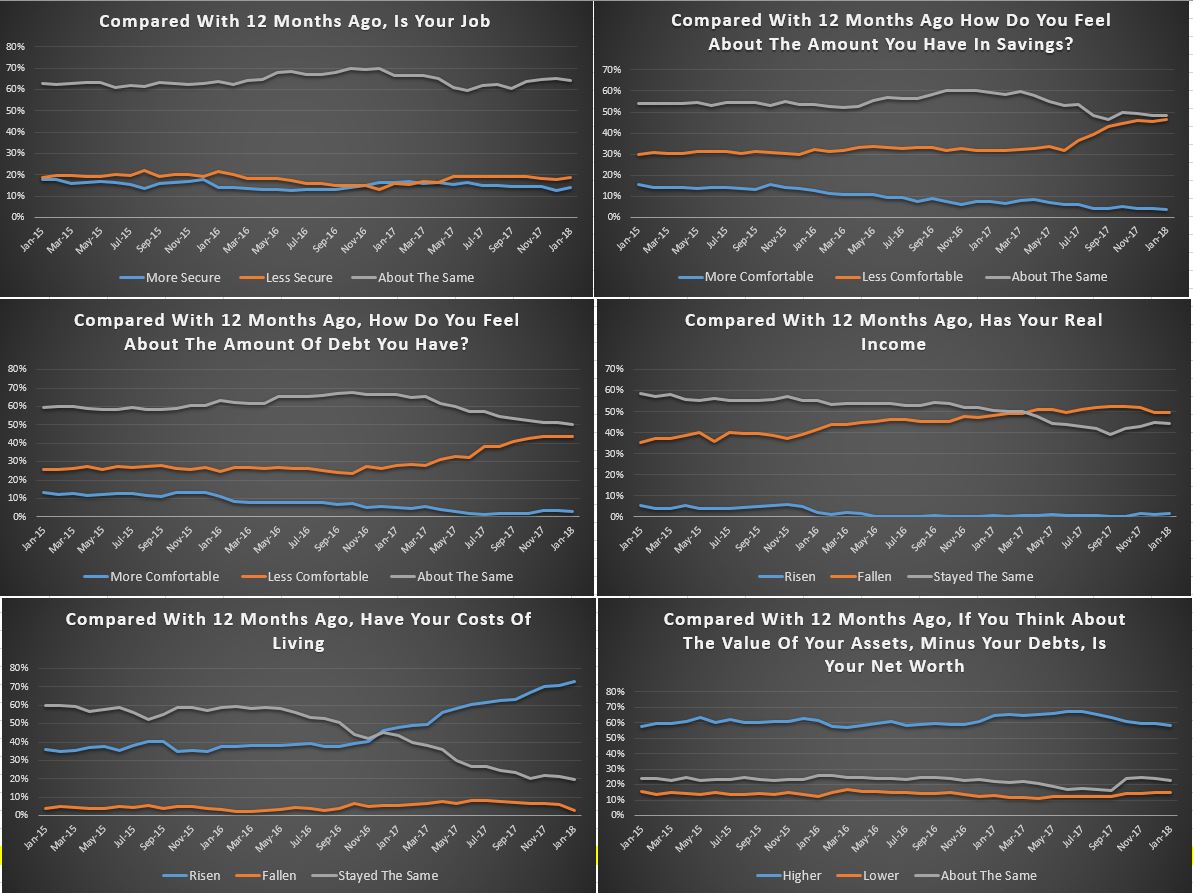

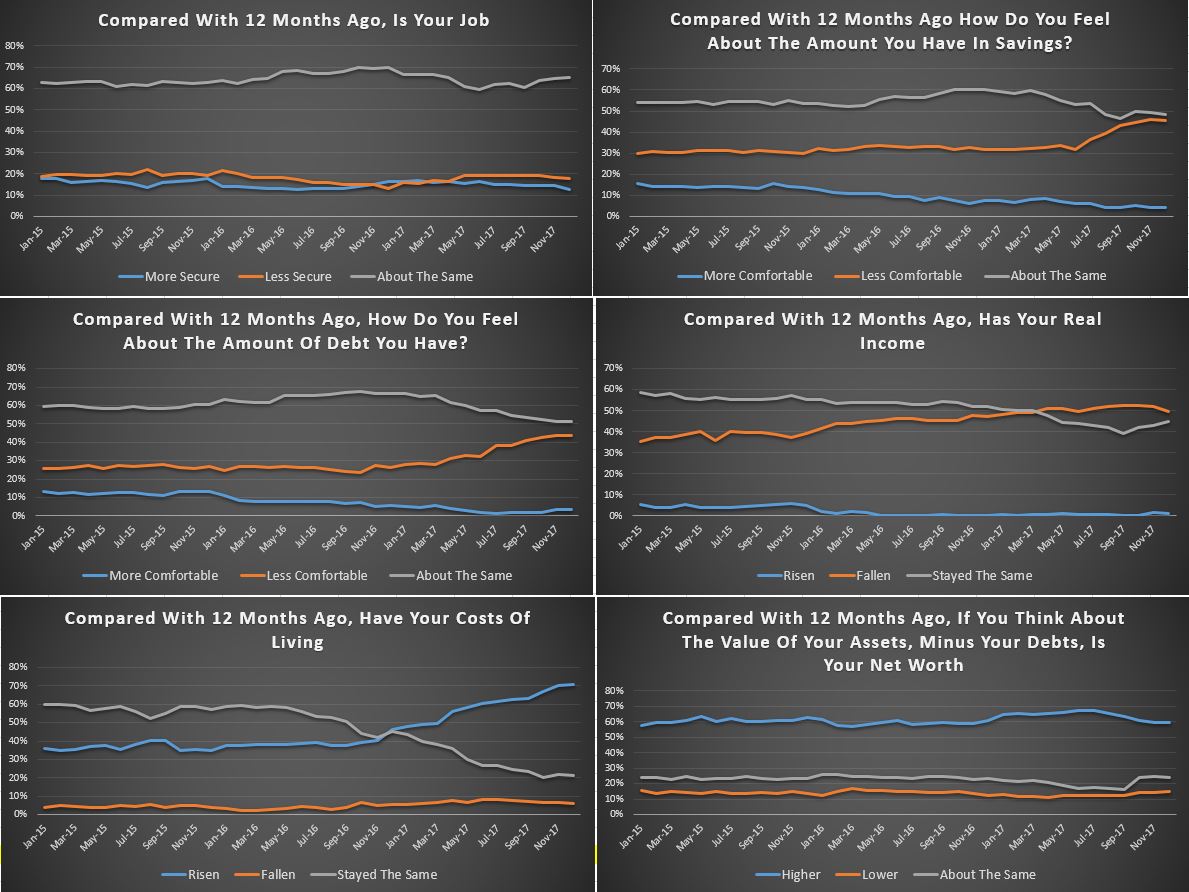

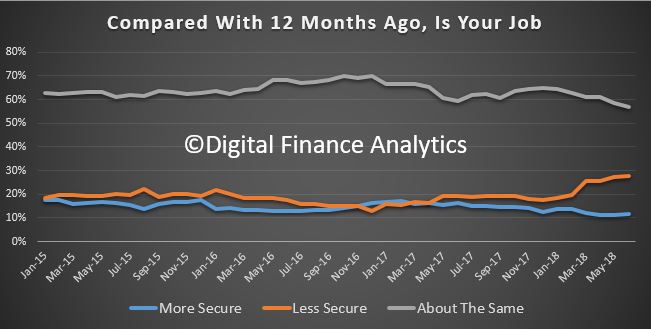

We can examine the drivers across the dimensions in our survey. In terms of job security there was a small rise last month, with those feeling more secure up 0.65% to 11.8%. On the other hand, those less secure also rose by 0.78% to 27.9%, with a consistent theme of limited hours being to the fore. We continue to see a rise in households managing multiple concurrent part time jobs to make ends meet.

We can examine the drivers across the dimensions in our survey. In terms of job security there was a small rise last month, with those feeling more secure up 0.65% to 11.8%. On the other hand, those less secure also rose by 0.78% to 27.9%, with a consistent theme of limited hours being to the fore. We continue to see a rise in households managing multiple concurrent part time jobs to make ends meet.

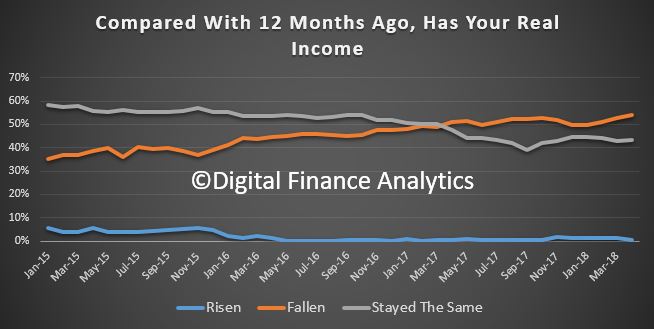

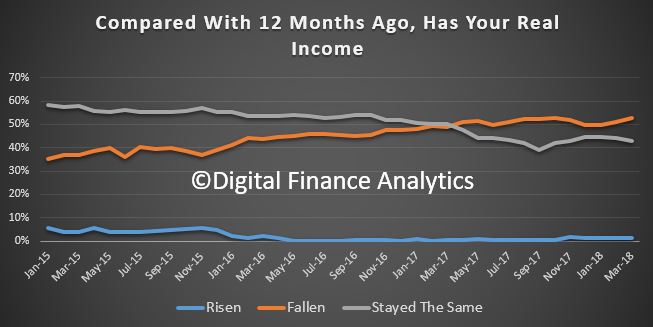

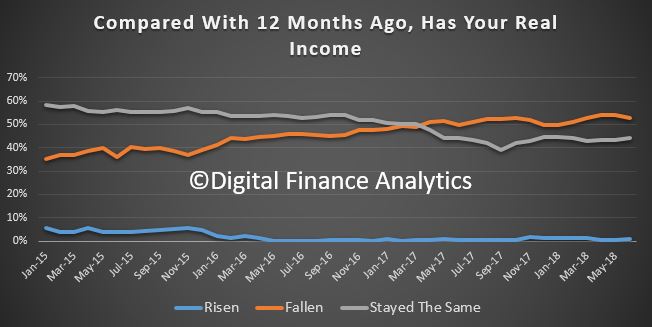

Turning to income, there was no indication of significant income rises before the new financial year, next month may be different. 52.7% said their incomes had fallen in real terms over the past year, and 44% reported no change. Once again we see evidence of limited hours driving underemployment higher, so on a gross income there is no light at the end of the tunnel, yet.

Turning to income, there was no indication of significant income rises before the new financial year, next month may be different. 52.7% said their incomes had fallen in real terms over the past year, and 44% reported no change. Once again we see evidence of limited hours driving underemployment higher, so on a gross income there is no light at the end of the tunnel, yet.

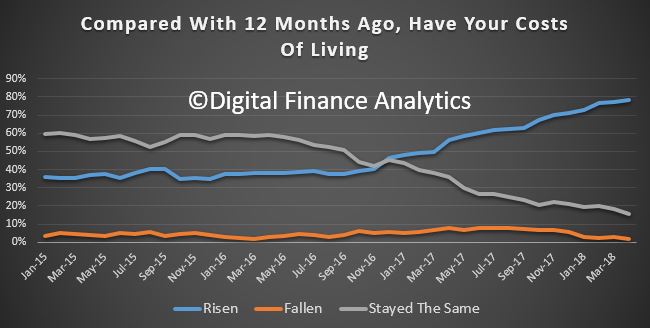

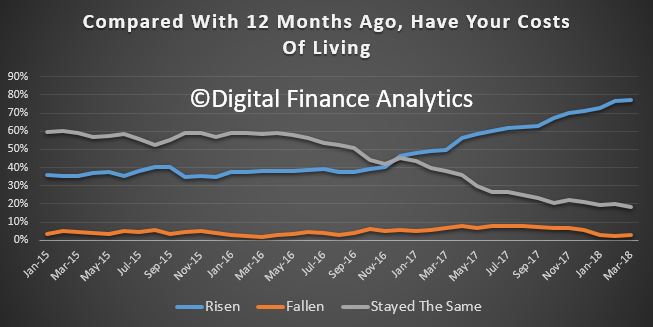

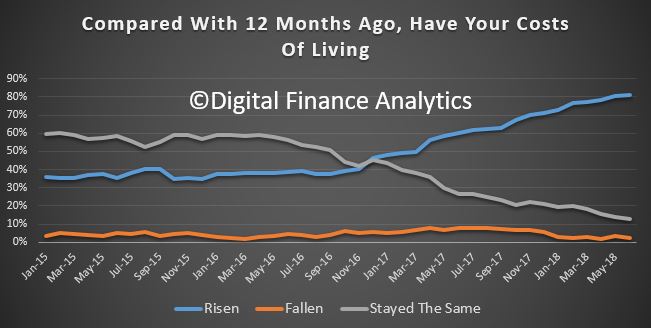

Costs of living continue to rise with 81.3% seeing their expenditure rising, thanks to the usual suspects, including electricity, child care, school fees and health insurance costs. There were also signs of pressure from food costs and council rates. Only 2.2% reported said their costs have fallen over the past 12 months. The reported CPI rates appear to be disconnected from reality.

Costs of living continue to rise with 81.3% seeing their expenditure rising, thanks to the usual suspects, including electricity, child care, school fees and health insurance costs. There were also signs of pressure from food costs and council rates. Only 2.2% reported said their costs have fallen over the past 12 months. The reported CPI rates appear to be disconnected from reality.

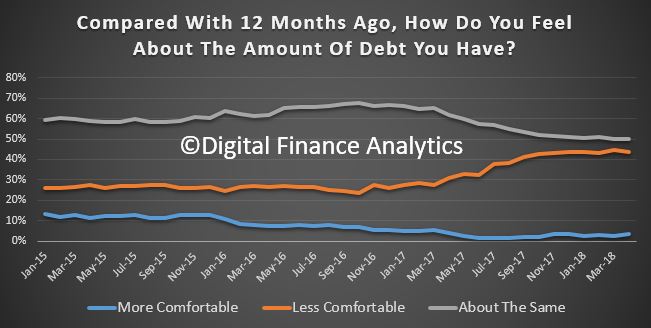

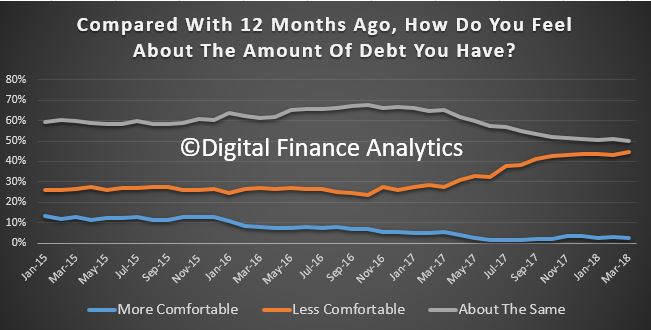

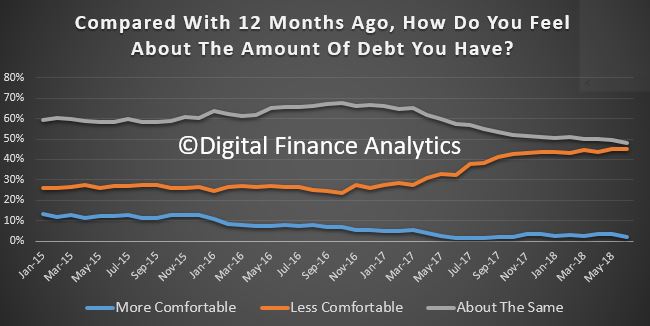

Debt remains a major issue, with mortgages being the front line. Households remain highly leveraged. Some households with lower Loan to Value ratios have been able to switch to other, cheaper loans, but more than 40% of households seeking to refinance have been knocked back in the past 3 months, up from 5% a year ago. A hallmark of the current lending environment. We also continue to see many households adding to their overall debt via credit cards, or other loans. The new positive credit environment which commenced 1 July 2018 will change the game ahead. Credit may become harder to source for some.

Debt remains a major issue, with mortgages being the front line. Households remain highly leveraged. Some households with lower Loan to Value ratios have been able to switch to other, cheaper loans, but more than 40% of households seeking to refinance have been knocked back in the past 3 months, up from 5% a year ago. A hallmark of the current lending environment. We also continue to see many households adding to their overall debt via credit cards, or other loans. The new positive credit environment which commenced 1 July 2018 will change the game ahead. Credit may become harder to source for some.

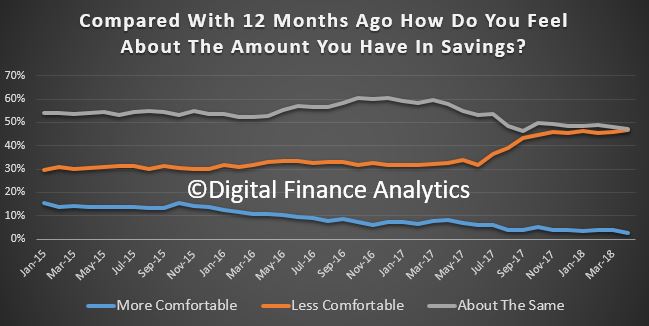

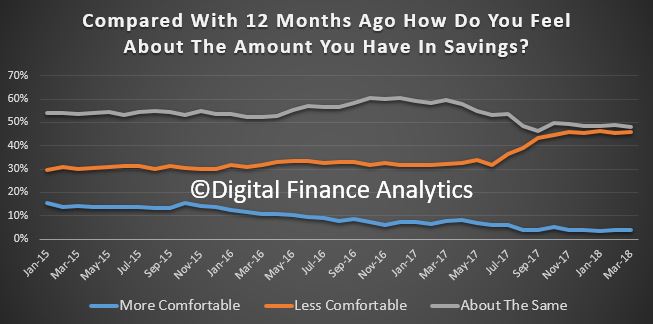

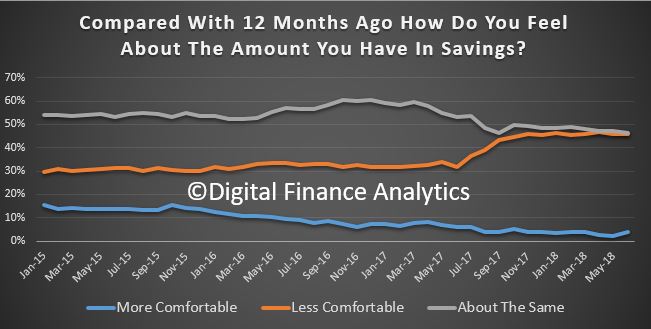

On the other hand, households continue to dip into their savings to maintain lifestyle and budgets. 46% of households are less comfortable with the level of their savings compared with a year ago. Many responses highlighted the recent collapse in bank deposit rates as ADI’s try to manage their margins. Around the same, 46% of household reported no change. Significantly more than one third of households with an owner occupied mortgage had savings LESS than the equivalent of one months mortgage repayment. The other two thirds had significantly larger resources which would insulate them in a down turn, at least for a time.

On the other hand, households continue to dip into their savings to maintain lifestyle and budgets. 46% of households are less comfortable with the level of their savings compared with a year ago. Many responses highlighted the recent collapse in bank deposit rates as ADI’s try to manage their margins. Around the same, 46% of household reported no change. Significantly more than one third of households with an owner occupied mortgage had savings LESS than the equivalent of one months mortgage repayment. The other two thirds had significantly larger resources which would insulate them in a down turn, at least for a time.

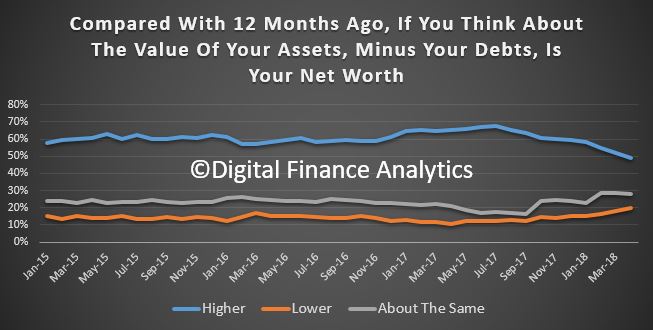

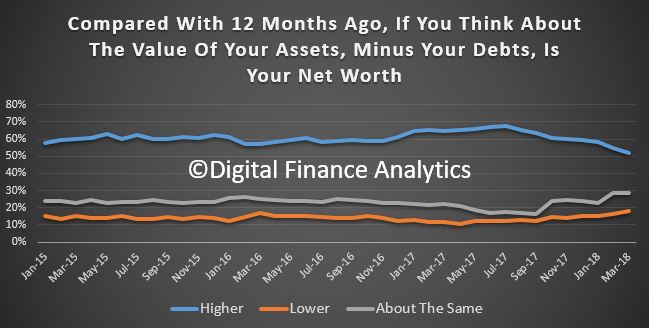

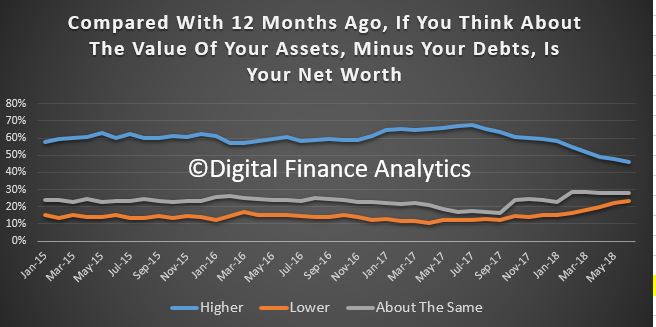

Finally, we see that more households are reporting a fall in net worth – total assets less loans and other liabilities, with 23% now saying they are worth less (up 0.95% on the month). 28% reported no change over the past year, and 46% reported growth in net worth, helped by the still significant run up in home prices in recent years (now correcting) and rises in stocks in recent months.

Finally, we see that more households are reporting a fall in net worth – total assets less loans and other liabilities, with 23% now saying they are worth less (up 0.95% on the month). 28% reported no change over the past year, and 46% reported growth in net worth, helped by the still significant run up in home prices in recent years (now correcting) and rises in stocks in recent months.

Generally those with more assets are still seeing rises compared with an average Australian household, highlighting the two-speed story across the country, depending on affluence.

But we also continue to see a tranche of highly leveraged high net-worth households having to cope with financial pressures as home prices and rentals move against them and the impact of switching from interest only to principal and interest loans hits home.

We would expect a small bounce in the index next month as some incomes rise in the new tax year and other changes take effect. But the impact of the fading property sector, and cash flow constraints are likely to dwarf this impact. The only “get out of jail card” will be income growth above inflation, and as yet there is little evidence of this occurring. Thus we expect the long grind to continue.

We would expect a small bounce in the index next month as some incomes rise in the new tax year and other changes take effect. But the impact of the fading property sector, and cash flow constraints are likely to dwarf this impact. The only “get out of jail card” will be income growth above inflation, and as yet there is little evidence of this occurring. Thus we expect the long grind to continue.

Finally, we see a number of attractor rates from the banks in an attempt to keep mortgage volumes up, but many households cannot access them in the new tighter lending environment. In addition the reduction in rates on some deposit accounts is also hitting the hip pockets of many who rely on income from them. We noted in the survey that a number of households were actively seeking alternative savings vehicles as property and bank deposits look less interesting. We will have to see whether these alternatives are as attractive (in terms of risk-return) as some are claiming. We have our doubts. But then risk is relative.

By way of background, these results are derived from our household surveys, averaged across Australia. We have 52,000 households in our sample at any one time. We include detailed questions covering various aspects of a household’s financial footprint. The index measures how households are feeling about their financial health. To calculate the index we ask questions which cover a number of different dimensions. We start by asking households how confident they are feeling about their job security, whether their real income has risen or fallen in the past year, their view on their costs of living over the same period, whether they have increased their loans and other outstanding debts including credit cards and whether they are saving more than last year. Finally we ask about their overall change in net worth over the past 12 months – by net worth we mean net assets less outstanding debts.

We will update the index next month.