I review the final Senate report into Banking Separation with Robbie Barwick from the CEC.

Category: Economics and Banking

RBA Cuts Growth And Inflation Forecasts; Rate Cuts Will Follow

The RBA released their quarterly Statement On Monetary Policy today. Expect rate cuts, and QE later as the AUD is allowed to slide, as a decade of wrong policy is now coming home to roost. Plus they are tracking the labour market as a key determinate of policy using the wobbly ABS series data, looking past weaker inflation, and hoping for wages growth.

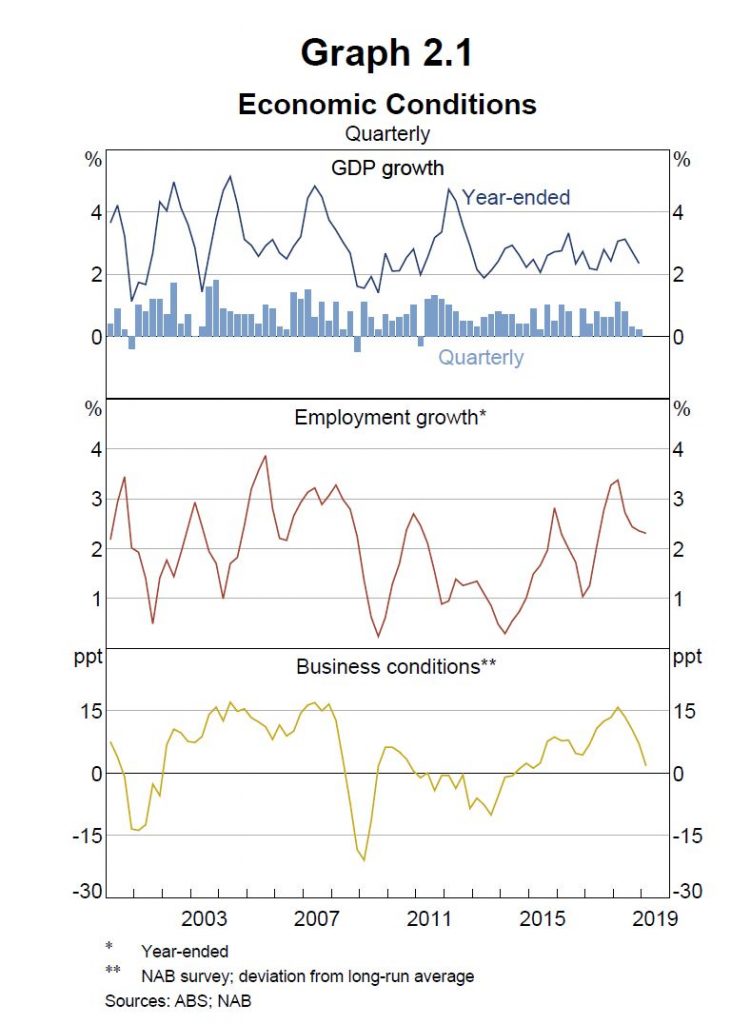

Growth in the Australian economy has slowed and inflation remains low. Subdued growth in household income and the adjustment in the housing market are affecting consumer spending and residential construction. Despite this, the labour market is performing reasonably well, with the unemployment rate steady at around 5 per cent. Underlying inflation has been lower than expected, at 1½ per cent over the year to the March quarter, with pricing pressures subdued across much of the economy.

GDP growth is expected to be around 2¾ per cent over both 2019 and 2020. This is lower than previously forecast, reflecting the revised outlook for household consumption spending and dwelling activity. Stronger growth in exports and, further out, work on new mining investment projects are expected to support growth. Forecasts for inflation have also been revised lower. Trimmed mean inflation is expected to be around 1¾ per cent over 2019 and then increase gradually to 2 per cent in 2020 and a touch above 2 per cent by early

In the near term, CPI inflation is expected to run a little above the rate for trimmed mean inflation, driven by the recent increase in petrol prices.

The Australian dollar is currently around the low end of the narrow range it has been in for some years. Sovereign bond rates in Australia have continued to decline relative to those in the major economies. This has tended to counteract the upward pressure on the exchange rate that would otherwise have come from rising prices for Australia’s key commodity exports.

Conditions in the established housing market remain soft. Housing prices have continued to decline in the largest cities, although the pace of decline has eased a bit recently. Some other indicators, including auction clearance rates, have improved a little since the end of last year, but generally point to continued soft conditions. Prices have also been declining in many other cities and regional areas.

Despite strong employment growth and some recovery in growth of average hourly earnings, growth in household income was very low over Non-labour sources of income have been subdued and are likely to remain so for a while, given the effects of the drought on farm incomes and of soft housing market conditions on the earnings of many other unincorporated businesses. Strong growth in tax payments has also subtracted from disposable income growth over recent years.

Weak growth in household income poses a key risk to the outlook for household consumption, especially in the context of falling housing prices and the need for many households to service high levels of debt. Some recovery in income growth is likely, because employment growth is expected to remain solid, wages are expected to increase and the tax offset for low and middle-income taxpayers is set to come into effect in the second half of this year.

At its recent meeting, the Board focused on the implications of the low inflation outcomes for the economic outlook. It concluded that the ongoing subdued rate of inflation suggests that a lower rate of unemployment is achievable while also having inflation consistent with the target. Given this assessment, the Board will be paying close attention to developments in the labour market at its upcoming meetings.

New Zealand Reserve Bank Cuts Cash Rate To 1.5%

The Official Cash Rate (OCR) has been reduced to 1.5 percent. They signalled risks from China and Australia, and that lower mortgage rates might help household finances and housing.

The Monetary Policy Committee decided a lower OCR is necessary to support the outlook for employment and inflation consistent with its policy remit.

Global economic growth has slowed since mid-2018, easing demand for New Zealand’s goods and services. This lower global growth has prompted foreign central banks to ease their monetary policy stances, supporting growth prospects.

However, there is uncertainty about the global economic outlook. Trade concerns remain, while some other indicators suggest trading-partner growth is stabilising.

Domestic growth slowed from the second half of 2018. Reduced population growth through lower net immigration, and continuing house price softness in some areas, has tempered the growth in household spending. Ongoing low business sentiment, tighter profit margins, and competition for resources has restrained investment.

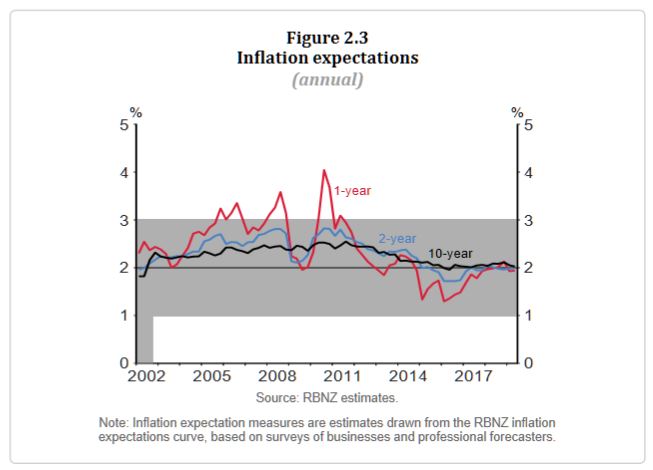

Employment is near its maximum sustainable level. However, the outlook for employment growth is more subdued and capacity pressure is expected to ease slightly in 2019. Consequently, inflationary pressure is projected to rise only slowly.

Given this employment and inflation outlook, a lower OCR now is most consistent with achieving our objectives and provides a more balanced outlook for interest rates.

Summary record of meeting – May 2019 Statement

The Monetary Policy Committee agreed on the economic projections outlined in the May 2019 Statement in order to provide a sound basis on which to form its OCR decision.

The Committee noted that inflation is currently slightly below the mid-point of the inflation target, and that employment is broadly at the targeted maximum sustainable level. However, the members agreed that given the recent weaker domestic spending, and projected ongoing growth and employment headwinds, there was a need for further monetary stimulus to meet its objectives.

The Committee agreed that the risks to achieving its consumer price inflation and maximum sustainable employment objectives were broadly balanced around the projection. Possible alternative outcomes were noted on the upside and downside.

A key downside risk relating to the growth projections was a larger than anticipated slowdown in global economic growth, particularly in China and Australia, New Zealand’s largest trading partners. The Committee agreed that the projections adequately captured the observed global slowdown and its impact on domestic employment and inflation.

The Committee noted that additional stimulus from central banks had underpinned growth and reduced the likelihood of a more-pronounced slowdown. With some indicators of global growth improving in recent months, a faster recovery in global growth was possible. However, on balance, the Committee was more concerned about a continued slowdown rather than a faster recovery.

The Committee discussed other potential risks to domestic spending. The members acknowledged the importance of additional spending from households, businesses, and the government, to meet their inflation and employment targets. However, they noted several important uncertainties.

The Committee noted upside and downside risks to the investment outlook. Capacity pressure could see investment increase faster than assumed. On the downside, if sentiment remained low as profitability remains squeezed, investment might not increase as anticipated over the medium term. It was also noted that firms’ ability to invest is constrained by the current competition for resources.

A potential source of additional demand discussed by the Committee included government spending being higher than currently projected, in view of the current strength of the Crown balance sheet. This view was balanced by the impact of any increase in government investment being delayed, for example due to timing of the implementation of new initiatives and current capacity constraints in the construction sector. The implications for monetary policy remain to be seen.

Some members noted that with lower mortgage rates and easing of loan-to-value requirements, any possible pick-up in the housing market could support household spending growth more than anticipated.

The Committee noted that employment is currently near its maximum sustainable level. However, it was agreed that the outlook for employment growth is more subdued and capacity pressure is expected to ease slightly in 2019.

The Committee agreed that overall risks to the inflation projection were balanced. The Committee noted the outlook for inflation is below the target mid-point for longer than projected in the February Statement.

The recent period of rising domestic inflation was discussed. The Committee noted that the near-term outlook was more subdued due to lower capacity pressure. It was also noted that cost pressures remain elevated, and that there is a risk firms may pass these costs on as higher consumer prices by more than assumed. However, it was agreed that inflation expectations remain well anchored at the mid-point of the target range.

The Committee also noted the relatively subdued private sector wage growth, despite businesses suggesting that the inability to find labour is a significant constraint on their growth. The Committee noted the limited pass-through of the nominal wage growth to consumer price inflation.

Some members noted slower global growth reducing imported inflation was a downside risk to the inflation outlook.

The Committee reached a consensus that, relative to the February Statement, a lower path for the OCR over the projection period was appropriate. The lower path reflected the economic projections and the balance of risks discussed, and is consistent with both inflation and employment remaining near the Committee’s objectives.

After discussing the relative benefits of holding the OCR and committing to a downward bias, versus cutting the OCR now so as to establish a more balanced outlook for interest rates, the Committee reached a consensus to cut the OCR to 1.50 percent.

RBA Holds, As We Expected

At its meeting today, the Board decided to leave the cash rate unchanged at 1.50 per cent. They reinforced the labour market as the key to future rate moves, looking past lower inflation. That is a pretty strong signal about what would lead to a cut. They are still reciting stronger growth than many believe is feasible.

Franking, cutting now would be using using up the limited ammo they have, for no good reason. Savers will be relieved!

The outlook for the global economy remains reasonable, although the risks are tilted to the downside. Growth in international trade has declined and investment intentions have softened in a number of countries. In China, the authorities have taken steps to support the economy, while addressing risks in the financial system. In most advanced economies, inflation remains subdued, unemployment rates are low and wages growth has picked up.

Global financial conditions remain accommodative. Long-term bond yields are low, consistent with the subdued outlook for inflation, and equity markets have strengthened. Risk premiums also remain low. In Australia, long-term bond yields are at historically low levels and short-term bank funding costs have declined further. Some lending rates have declined recently, although the average mortgage rate paid is unchanged. The Australian dollar is at the low end of its narrow range of recent times.

The central scenario is for the Australian economy to grow by around 2¾ per cent in 2019 and 2020. This outlook is supported by increased investment in infrastructure and a pick-up in activity in the resources sector, partly in response to an increase in the prices of Australia’s exports. The main domestic uncertainty continues to be the outlook for household consumption, which is being affected by a protracted period of low income growth and declining housing prices. Some pick-up in growth in household disposable income is expected and this should support consumption.

The Australian labour market remains strong. There has been a significant increase in employment, the vacancy rate remains high and there are reports of skills shortages in some areas. Despite these positive developments, there has been little further progress in reducing unemployment over the past six months. The unemployment rate has been broadly steady at around 5 per cent over this time and is expected to remain around this level over the next year or so, before declining a little to 4¾ per cent in 2021. The strong employment growth over the past year or so has led to some pick-up in wages growth, which is a welcome development. Some further lift in wages growth is expected, although this is likely to be a gradual process.

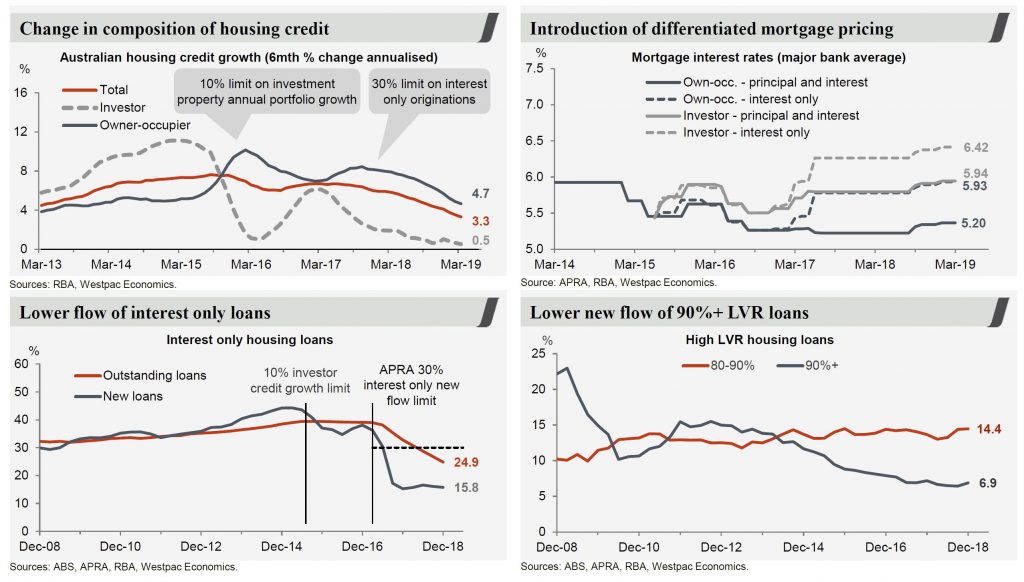

The adjustment in established housing markets is continuing, after the earlier large run-up in prices in some cities. Conditions remain soft and rent inflation remains low. Credit conditions for some borrowers have tightened over the past year or so. At the same time, the demand for credit by investors in the housing market has slowed noticeably as the dynamics of the housing market have changed. Growth in credit extended to owner-occupiers has eased over the past year. Mortgage rates remain low and there is strong competition for borrowers of high credit quality.

The inflation data for the March quarter were noticeably lower than expected and suggest subdued inflationary pressures across much of the economy. Over the year, inflation was 1.3 per cent and, in underlying terms, was 1.6 per cent. Lower housing-related costs and a range of policy decisions affecting administered prices both contributed to this outcome. Looking forward, inflation is expected to pick up, but to do so only gradually. The central scenario is for underlying inflation to be 1¾ per cent this year, 2 per cent in 2020 and a little higher after that. In headline terms, inflation is expected to be around 2 per cent this year, boosted by the recent increase in petrol prices.

The Board judged that it was appropriate to hold the stance of policy unchanged at this meeting. In doing so, it recognised that there was still spare capacity in the economy and that a further improvement in the labour market was likely to be needed for inflation to be consistent with the target. Given this assessment, the Board will be paying close attention to developments in the labour market at its upcoming meetings.

Westpac Drops Profit By 24%: Video

We review the latest Westpac results, and look in detail at their mortgage lending standards.

Westpac Drops Profit 24%

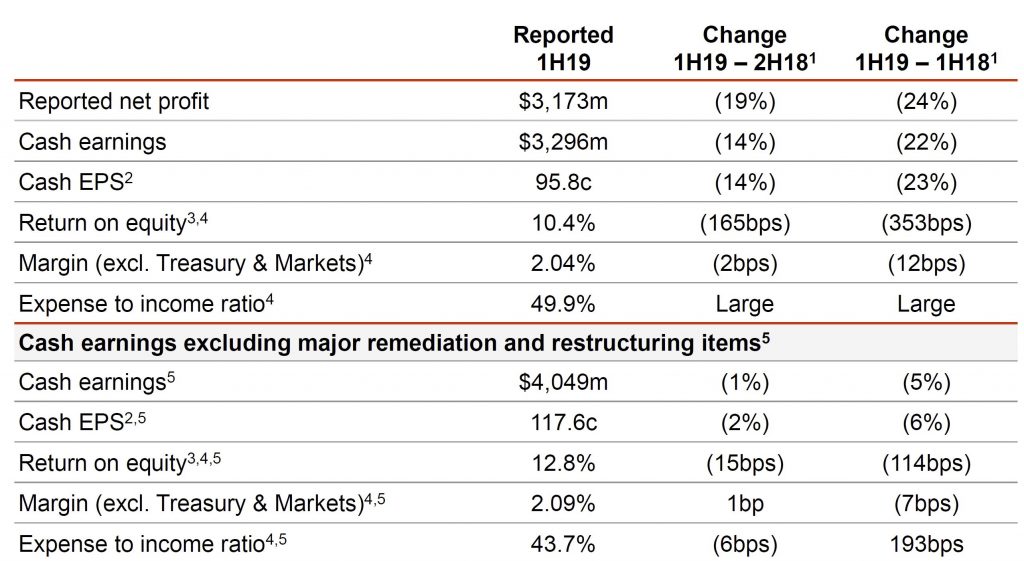

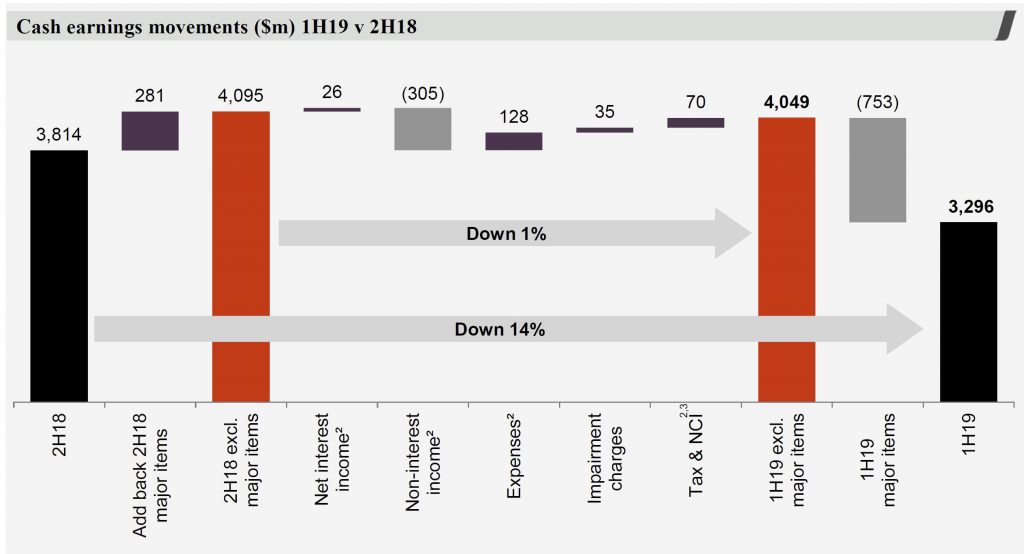

Westpac released their 1H19 results today and declared a statutory net profit of $3,173 million, down 24%. It would have been worse, but for lower than expected provisioning at $0.33 billion. Revenue was weaker than expected as they were hit by slower mortgage lending and weaker treasury. Margin is under pressure, but customer remediation costs continue to rise.

Cash earnings were $3,296 million, down 22% and cash earnings per share at 95.8 cents was down 23%.

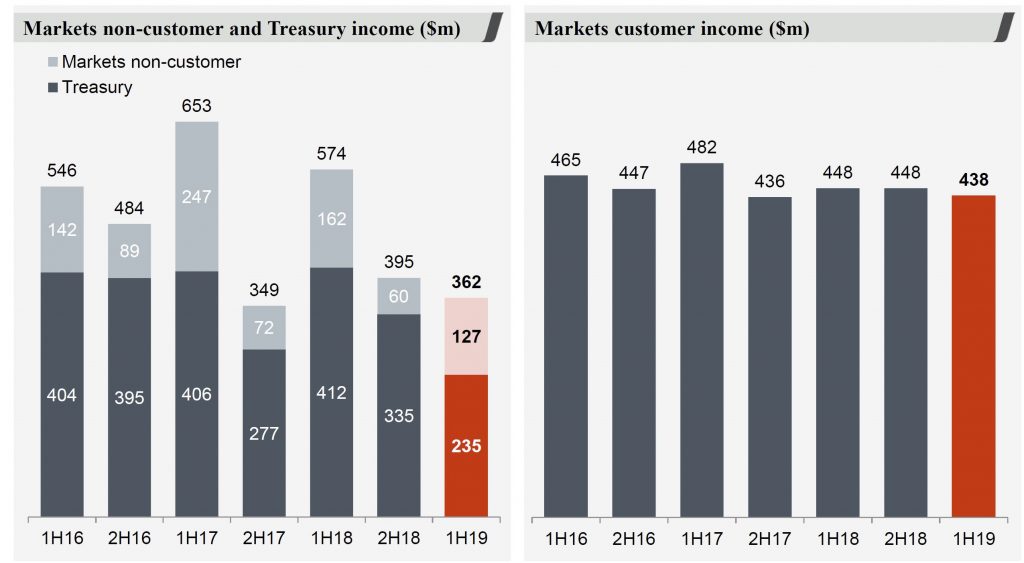

Market and Treasury Income was down 5% this half excluding derivative valuation adjustments.

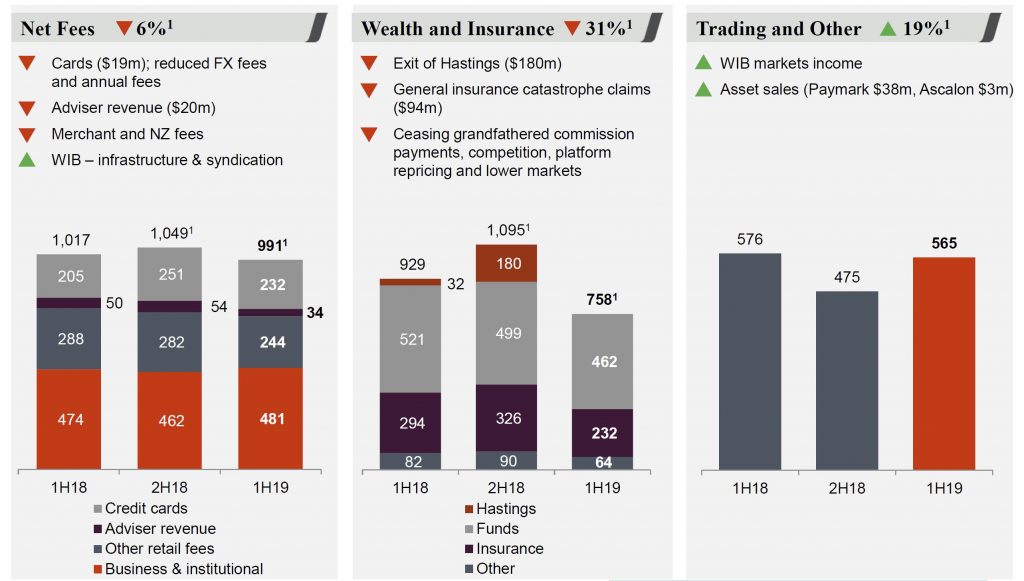

Non-interest income was down 30%, or 12% excluding major items (including provisions for estimated customer refunds, payments and associated costs, along with restructuring costs associated with resetting the Group’s wealth strategy).

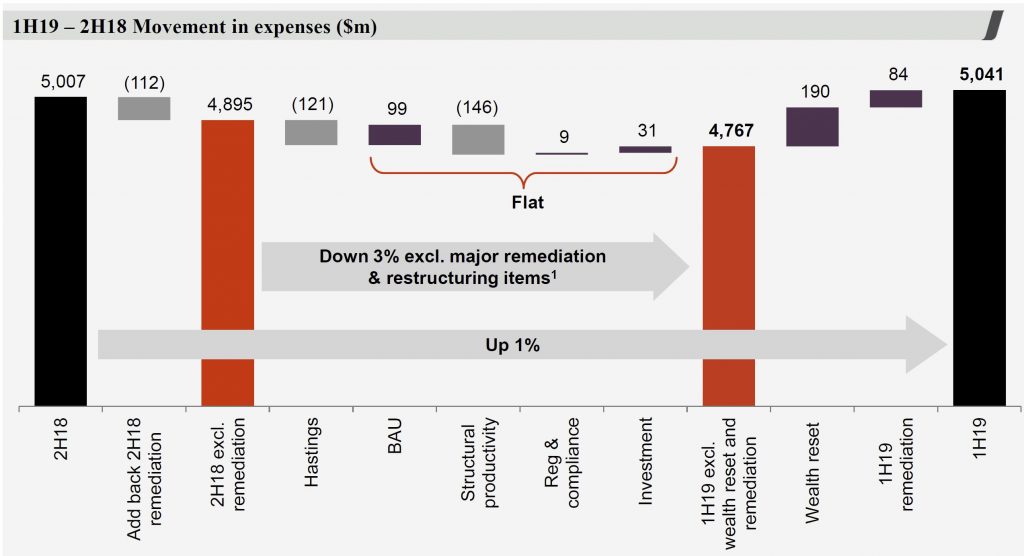

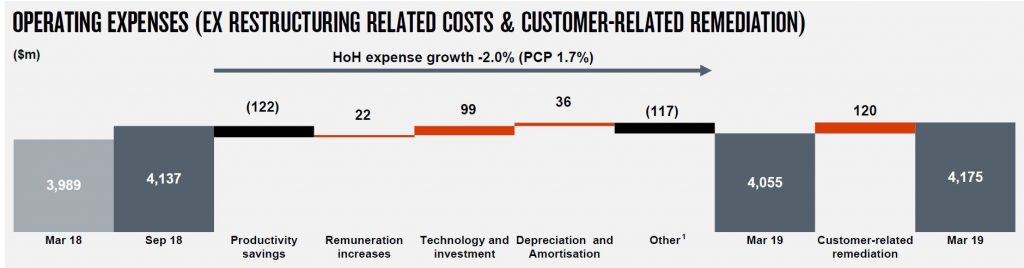

They claim there was a focus on expense management, though overall expenses were 1% higher.

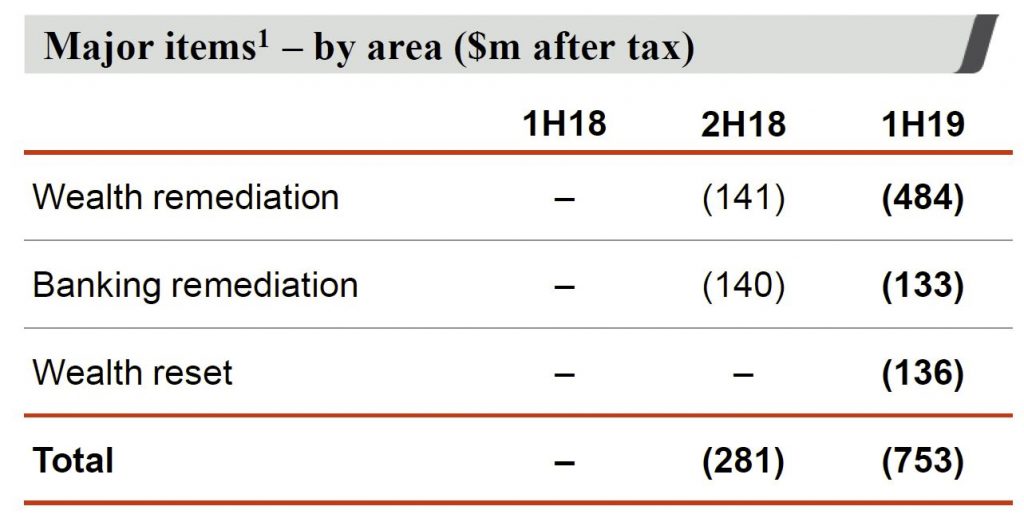

Cash earnings, excluding major remediation and restructuring items of $753 million (after tax), was down 5%.

Westpac has provisioned $1,445 million pre-tax in total over the past three years to work on its customer remediation programs, including $1,249 million for customer refunds. $896 million pre-tax in provisions were made this half ($617 million post-tax). They have more than 400 employees working directly on remediation projects and over the past 18 months, they have repaid around $200 million to customers.

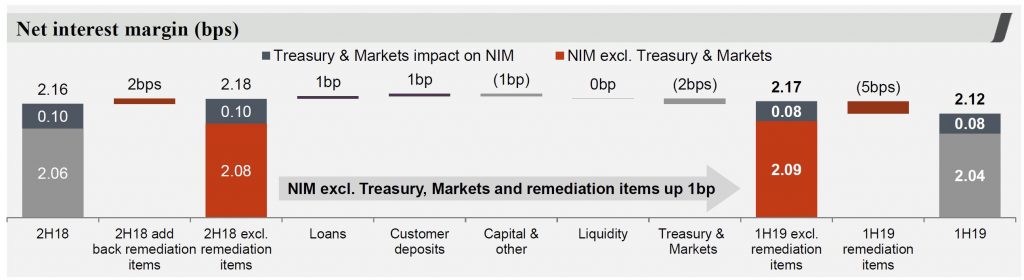

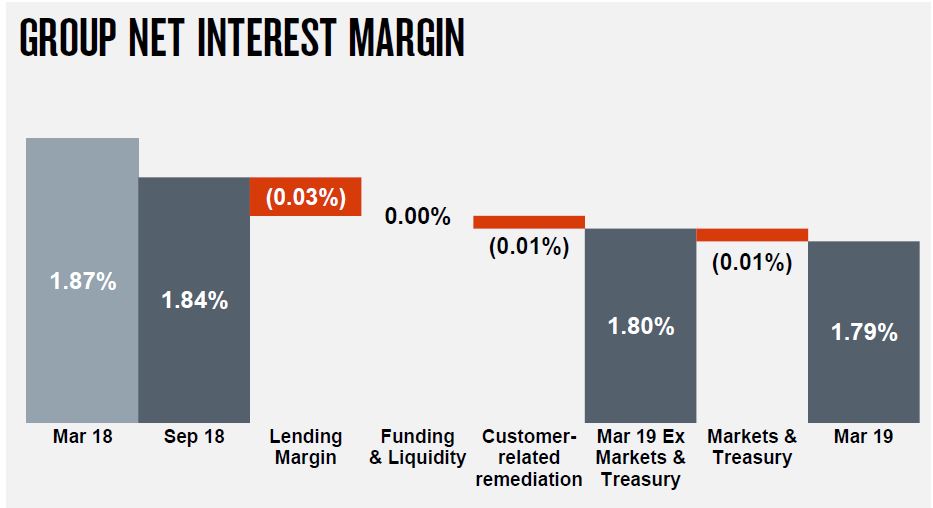

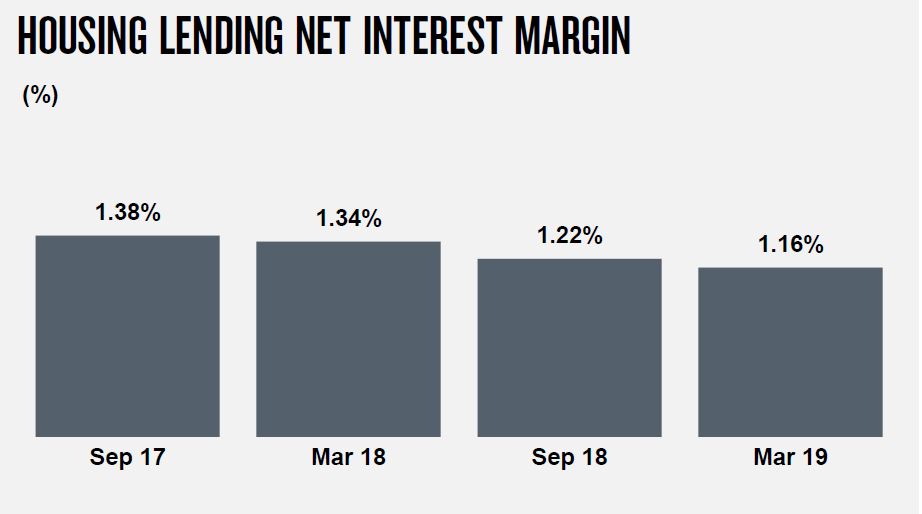

The bank’s net interest margin (excluding Treasury & Markets) was down 12 basis points from 1H18 due to provisions for customer refunds and higher short-term funding costs. There was also a 4bps decrease in Treasury & Markets primarily from Treasury interest rate risk management.

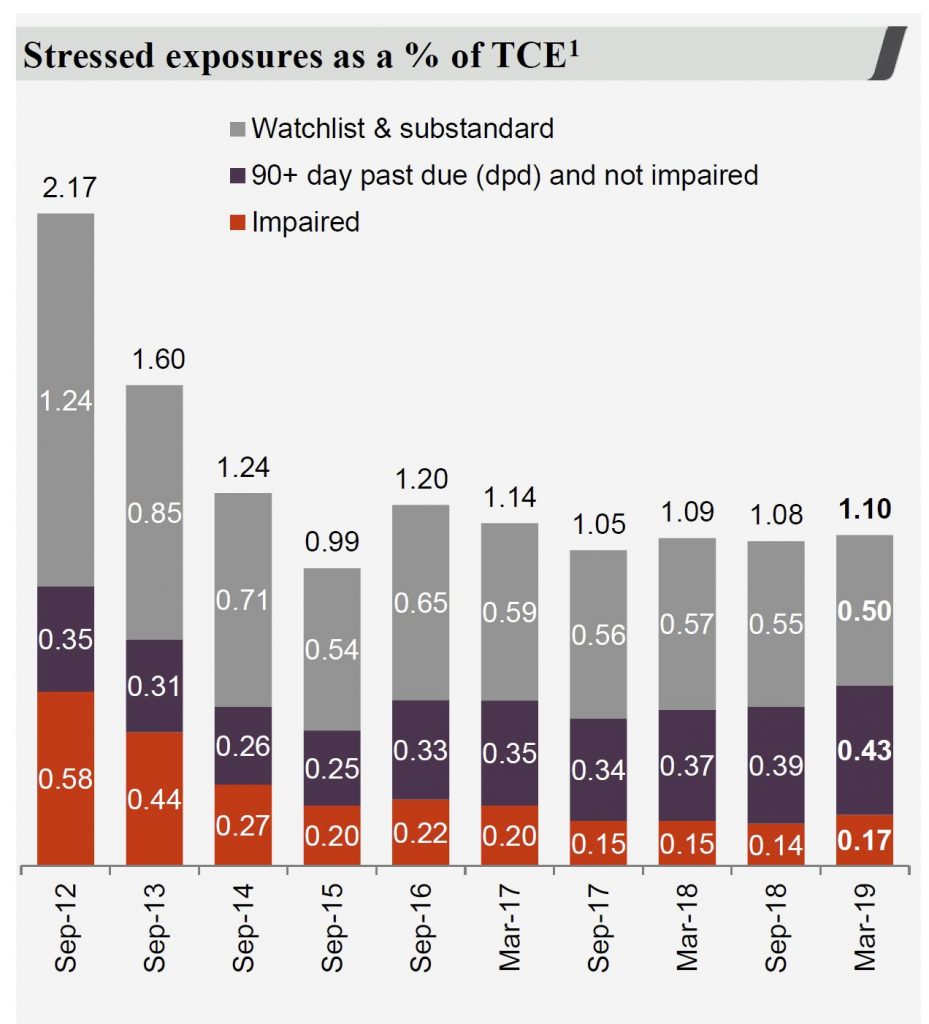

There was a rise in 90 day plus past due and impaired, with stressed exposures rising from 1.08% to 1.10% from the previous half.

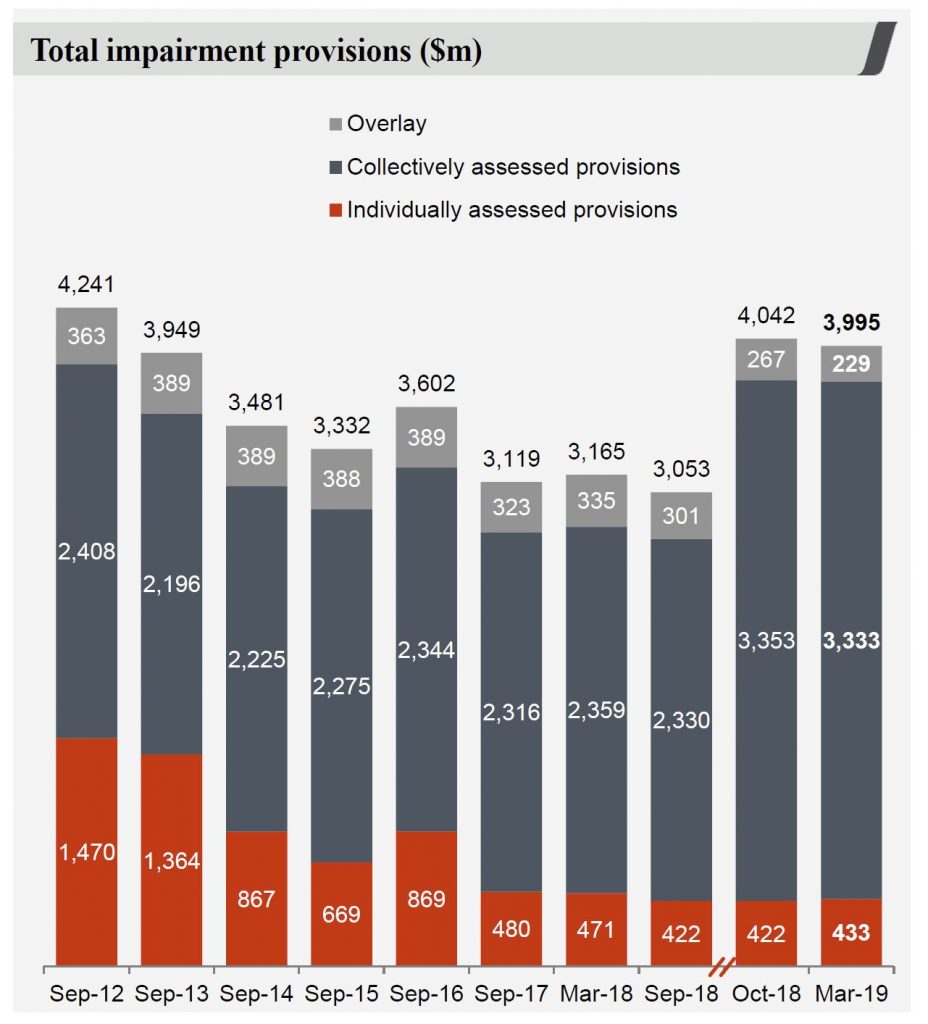

Total impairment provisions fell slightly from Oct 18, despite individually assesses provisions slightly higher. The economic overlay was weirdly reduced (despite the weaker economy!).

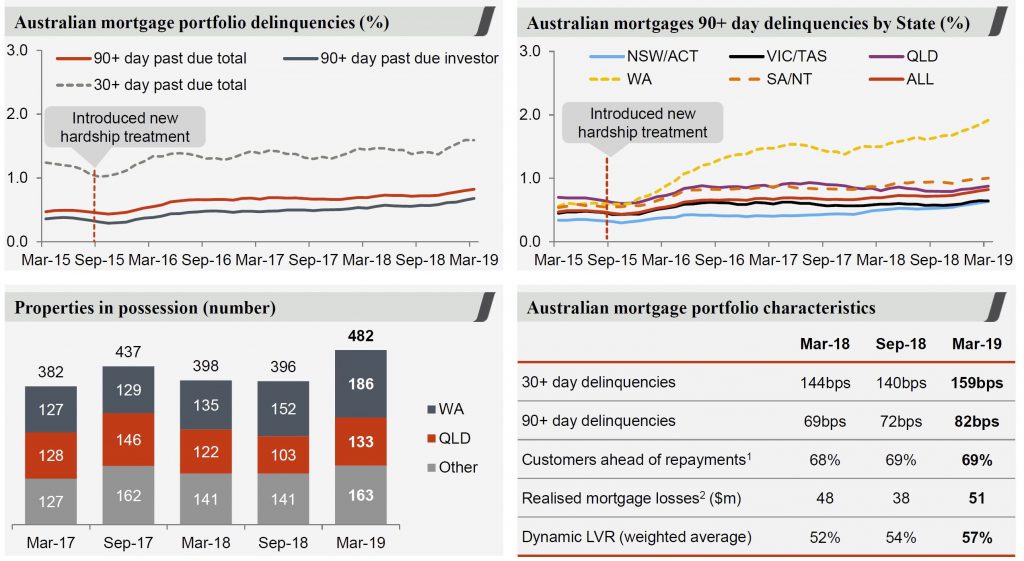

Mortgage delinquency in Australia continued to rise (as expected), with 482 properties in possession, compared with 396 last time (most were in WA or QLD). Past Due 90 days rose in most states, but WA lifted the most, and continues to reflect the weaker conditions in the west. They also called out rising delinquencies in NSW, a rise in P&I loans and longer cure times, together with the RAMs portfolio which has a higher delinquency profile. Total losses are at 2 basis points, which is low.

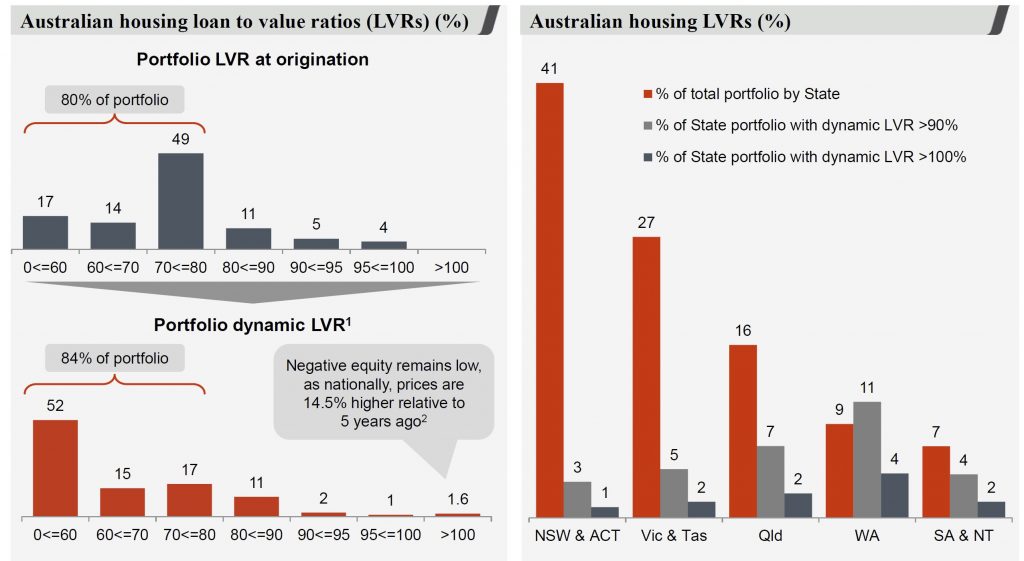

There was a rise in 100%+ LVR’s but is a small proportion of total book, based on data from Australian Property Monitor (but date not disclosed).

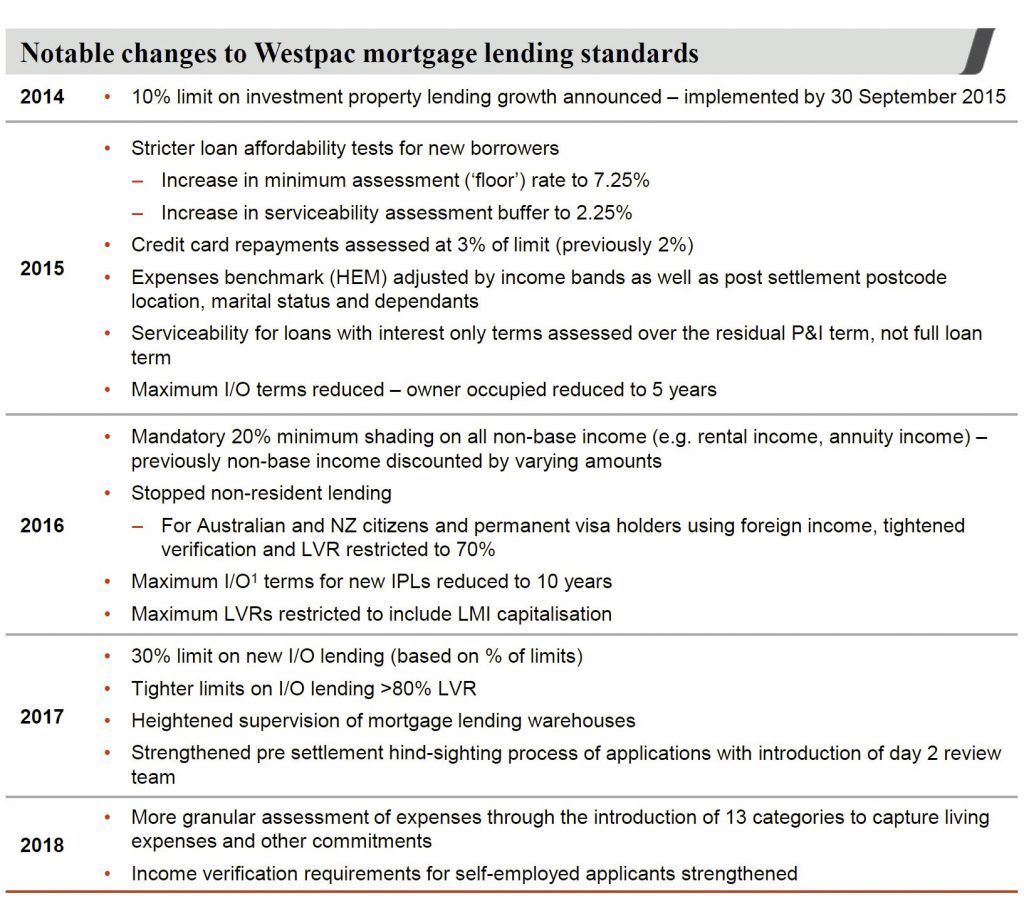

They have tightened lending standards significantly, and 62% of the portfolio were originated after the tightening. However, 19% of loans date from 2012-2014 and there are higher risks here.

90+ day delinquencies were 75 basis points for interest only loans, compared to Principal and interest rates were 83 basis points.

They made much of the better quality of new mortgage lending, but this begs the question about the back book in our view.

The banks return on equity (ROE) was 10.4%, and down 3.5 percentage points or excluding major remediation and restructuring items was, 12.8%.

They declared an interim fully franked dividend of 94 cents per share, which is unchanged

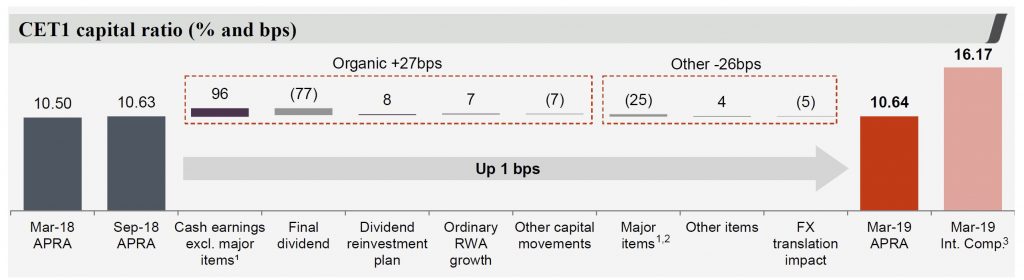

Their common equity Tier 1 capital ratio (CET1) of 10.64% is above APRA’s unquestionably strong benchmark

They foresee ongoing weakness in the Australian economy with subdued GDP growth this year expected to hold at around 2.2%. Consumers were being more cautious in the face of flat wages growth and a continuing soft housing market. They expect system credit growth to moderate, with pressure on margins to continue. But they expect credit quality to remain in good shape.

Turn And Turn About – The Property Imperative Weekly 04 May 2019

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Note at 4:25 Nasdaq was 7,845.73 (not what I said in the recording).

Dangerous Derivatives And Why Our Banks Are Hiding Them

I discuss the risks to our banks from the poorly understood derivatives sector with Robbie Barwick from the CEC. It’s one BIG problem!

Please share this post to help to spread the word about the state of things….

Caveat Emptor! Note: this is NOT financial or property advice!!

NAB 1H19 Cuts Dividend, Mortgage Arrears Rise

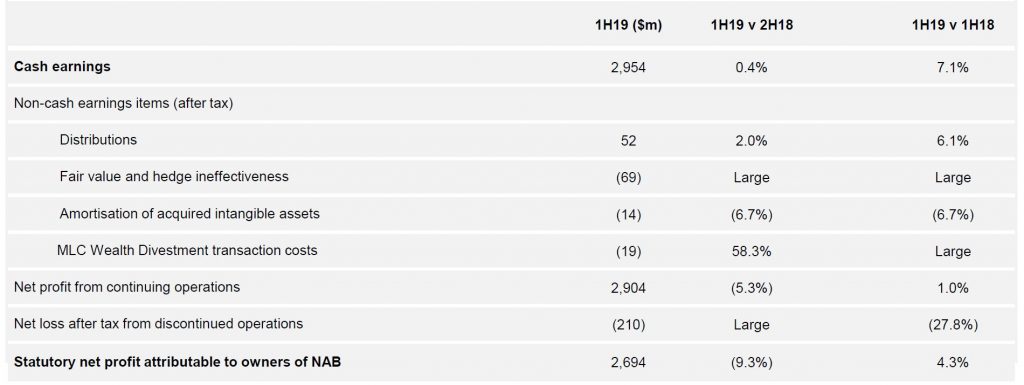

NAB reported their IH2019 results today. The statutory net profit in 1H19 was $2,694 million dollars, which is 9.3% lower compared with the 2H18, but 4.3% higher than 1H18.

Significantly they dropped the dividend to 83 cents per share, a drop of 16.2% compared with 1H18 – this was more than was anticipated by the market. But this is still an annualised dividend of circa 6.4%, compared with CBA and ANZ who are around 5.7%. This will help NAB build capital.

The cash ROE excluding restructuring and customer remediation was down 60 basis points to 13%, compared to ANZ’s 11.7%.

There were a number of one-offs which impacted the cash earnings, (their preferred measure) of $2,954 million, which is up 0.4% from 2H18, and 7.1% from 1H18.

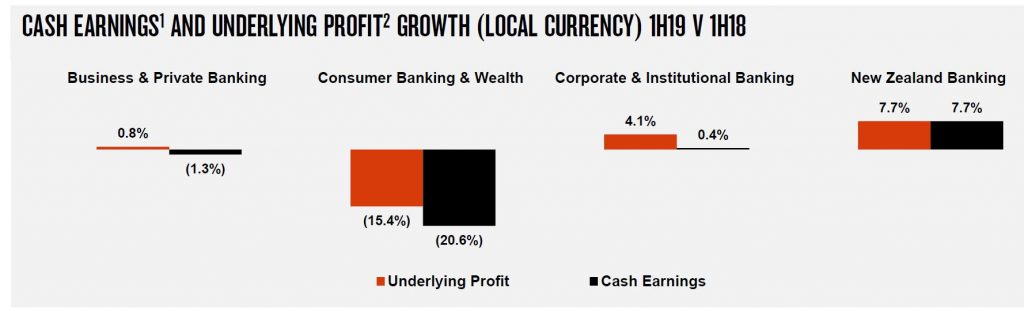

Consumer Banking dropped cash earnings by 20.6%.

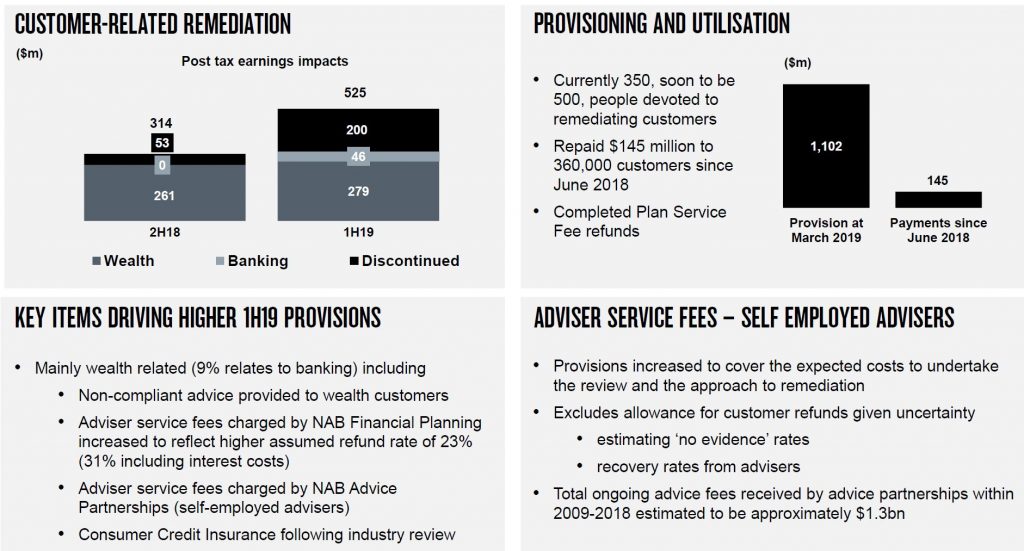

Customer remediation provisions stood at $1,102 million, and they plan to have 500 people devoted to this activity.

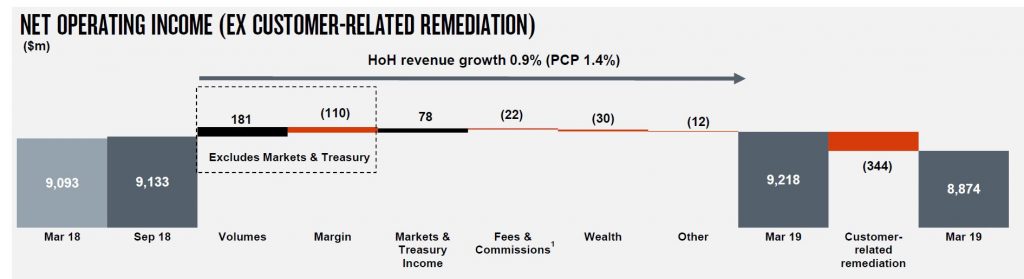

Overall income was higher, thanks to volume, but offset by margin compression of $110 million, a fall in fees and commissions, down $22 million and a customer remediation charge of $334 million, to give a net lower income of $8,874 million.

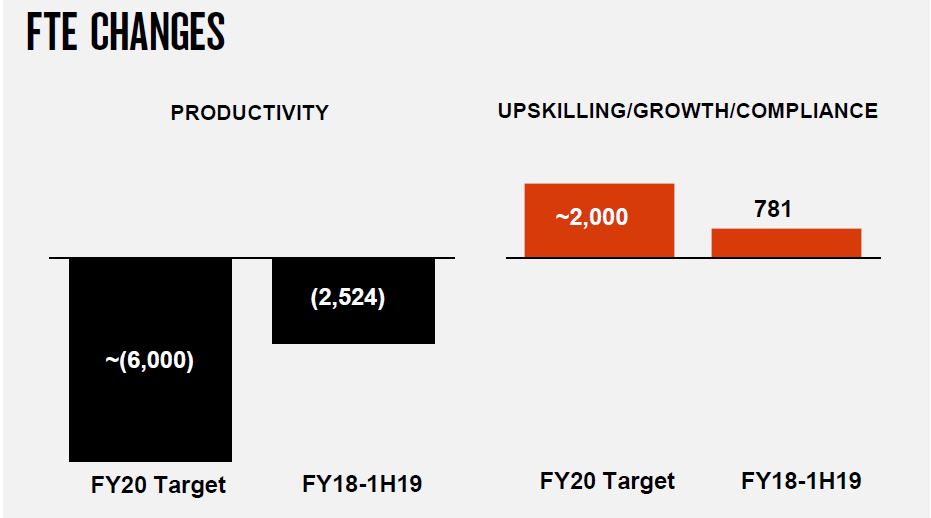

Operating expenses were flat(ish), but total FTE rose from 33,283 in 2H18 to 33,790 in 1H19.

They said that the banks is midway through its 3 year transformation program with additional investment target of $1.5bn, and that cost savings and FTE reduction are broadly on track.

Group net interest margin fell 7 basis points. Of course NAB delayed their Australian mortgage book repricing, and clearly this cost. Corporate and Institutional helped support the result. The subsequent mortgage repricing may help ahead.

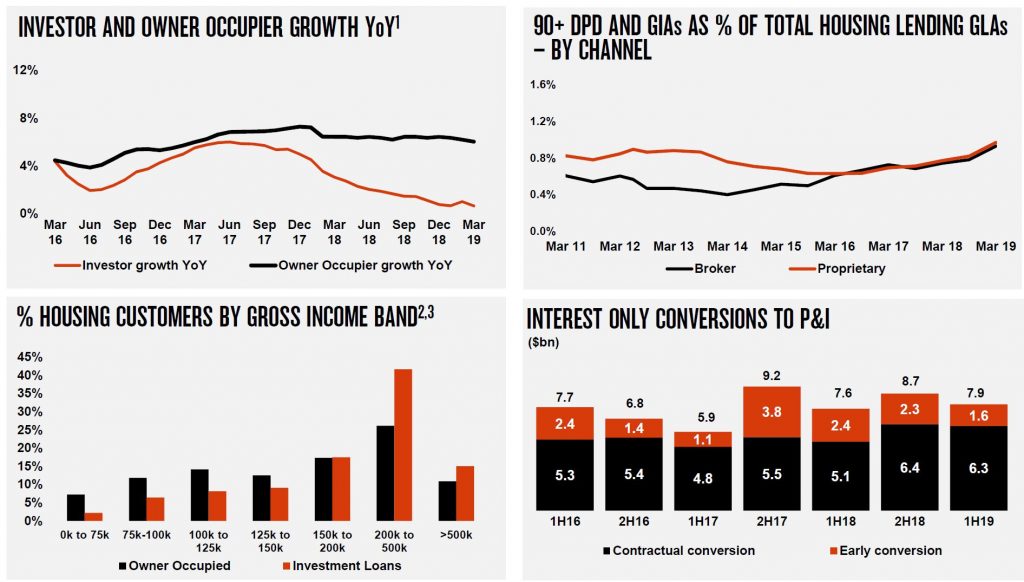

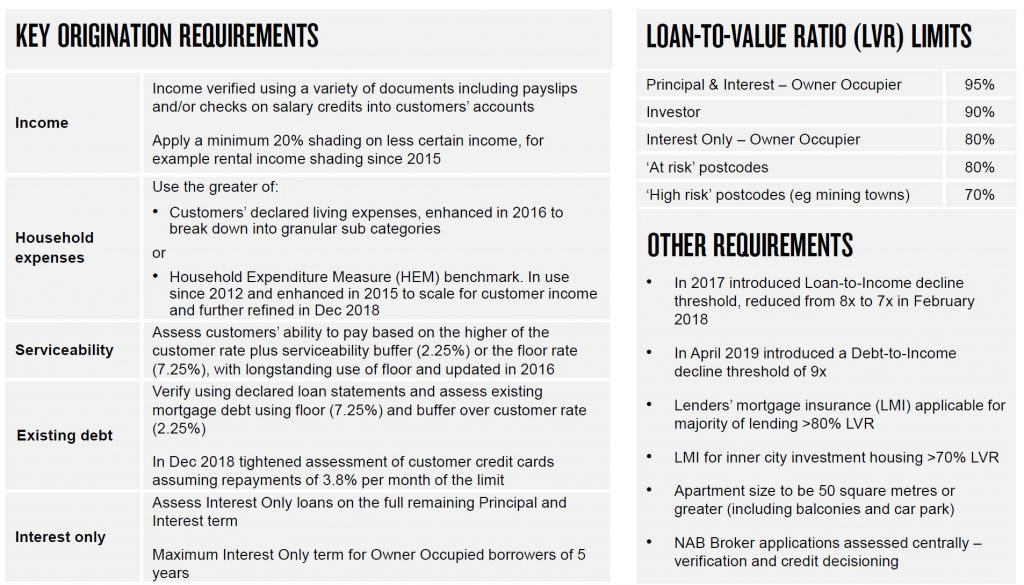

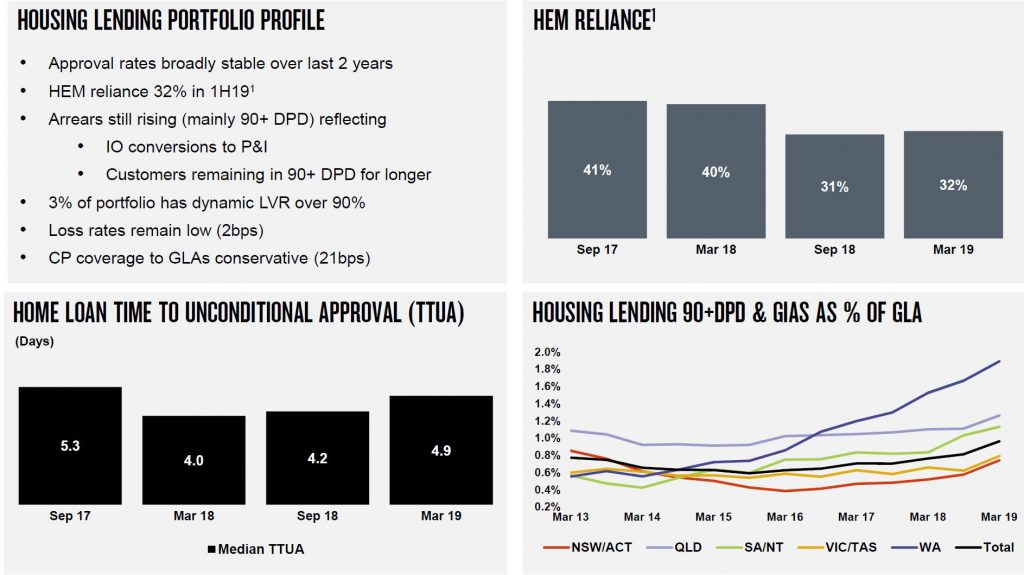

Home lending in Australia shows that approvals rates have remained stable over the past 2 years, and that reliance on HEM has fallen to 32% in March 19, compared with 41% in September 2017.

Net interest margin across Australian home loans fell 6 basis points from Sep 18 to Mar 19, and continues the slide from 2017.

Loan growth slowed, especially investor lending, and defaults are similar in both proprietary and broker channels now

They implemented Comprehensive Credit Reporting (CCR) for mortgages in February 2019 (first major bank to reach this milestone).

Lending standards have become tighter.

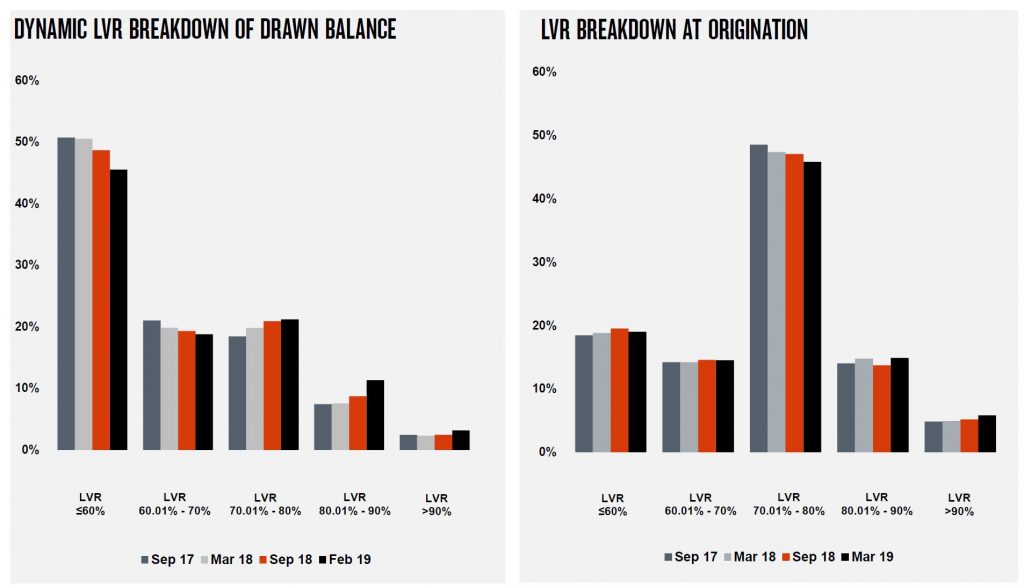

LVR Bands still include loans above 80% (and rising).

Default are rising, with 90 day+ defaults partly attributed to the conversion of interest only loans to P&I. WA has the highest levels, but other states also rose.

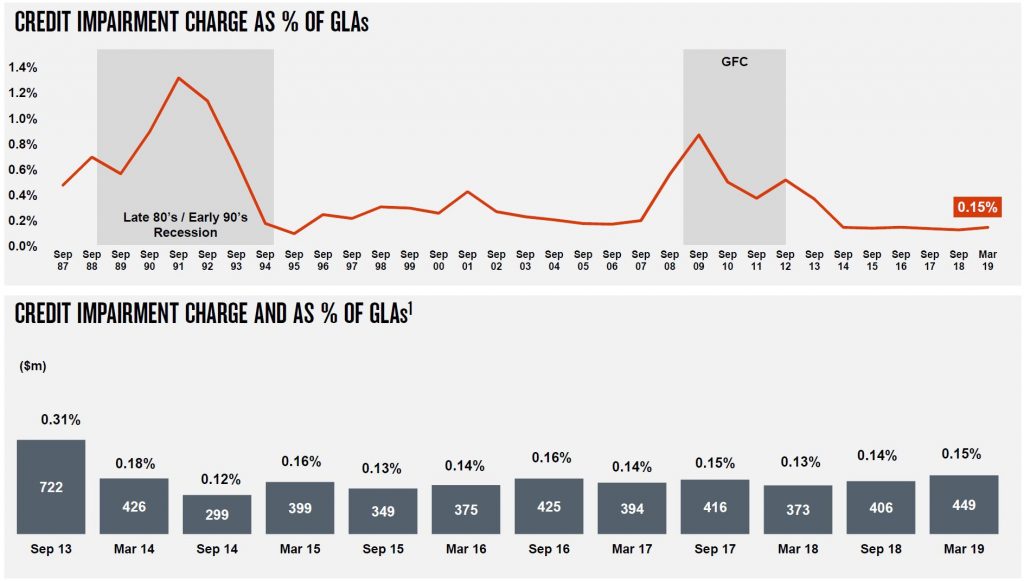

Group credit impairments rose to 0.15% of GLA’s.

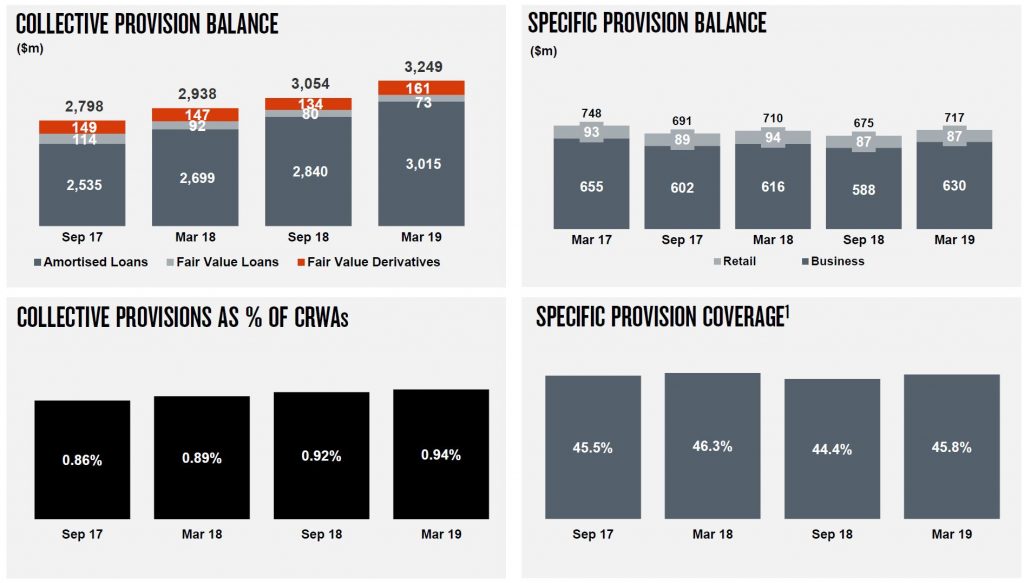

The group provisions are higher, as are the specific provision balances.

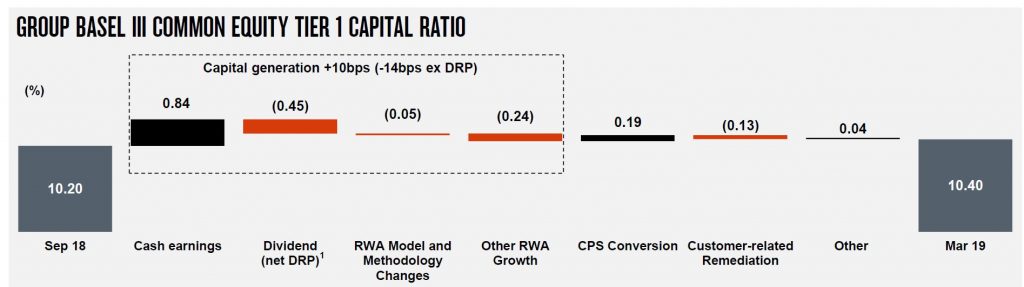

The CET1 ratio is 10.40, up from 10.20 in Sep 18, and they say they are on track for “unquestionably strong”.

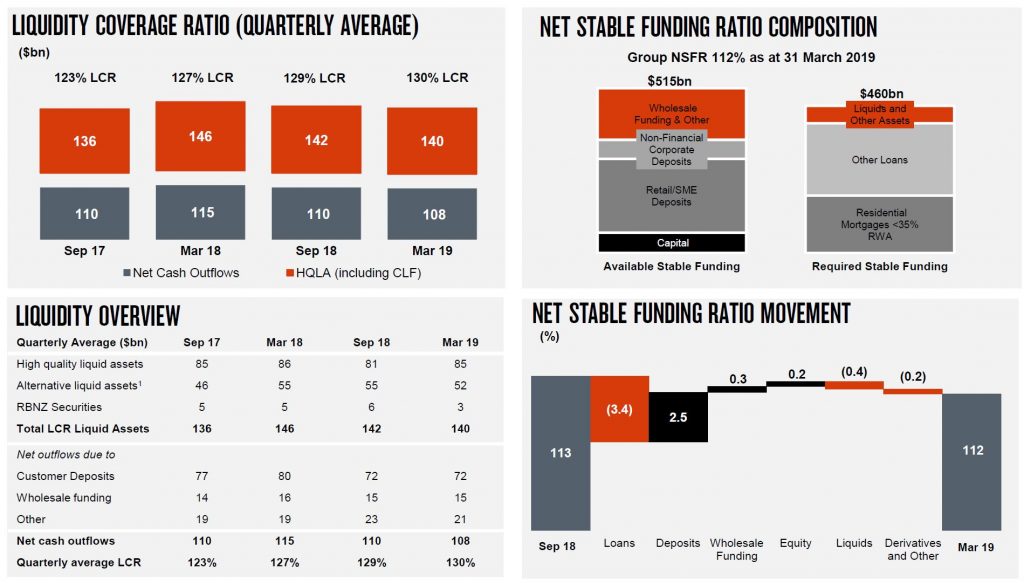

The LCR and NSFR remain strong.

So the underlying franchise still looks in reasonable shape, but the weakening housing sector needs to be watched.

Fed Holds, Cuts Unlikely

The Fed held their rate (some were expecting a cut), and as a result, markets eased back, while bond yields rose. They underscored the patient approach ahead, but also a willingness to look though low inflation in the nearer term.

The Board of Governors of the Federal Reserve System voted unanimously to set the interest rate paid on required and excess reserve balances at 2.35 percent, effective May 2, 2019. Setting the interest rate paid on required and excess reserve balances 15 basis points below the top of the target range for the federal funds rate is intended to foster trading in the federal funds market at rates well within the FOMC’s target range.

Information received since the Federal Open Market Committee met in March indicates that the labor market remains strong and that economic activity rose at a solid rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Growth of household spending and business fixed investment slowed in the first quarter. On a 12-month basis, overall inflation and inflation for items other than food and energy have declined and are running below 2 percent. On balance, market-based measures of inflation compensation have remained low in recent months, and survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent. The Committee continues to view sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective as the most likely outcomes. In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.