The Blockchain Insurance Industry Initiative (B3i) has unveiled a prototype application that streamlines contracts between insurers and reinsurers using blockchain technology according to Moody’s. Once the technology becomes mainstream, they expect that it will significantly reduce policy management expenses and speed up claims settlement for insurers and reinsurers, a credit positive.

B3i’s application gives insurers, reinsurers and brokers a shared view of policy data and documentation in real time.

Blockchain’s shared digital ledger has the potential to increase the speed and reduce the friction costs of reinsurance contract placements. Reinsurers would use the common platform to streamline claims analysis, potentially reducing significantly their administration and management costs.

Blockchain technology is a chain of blocks of encrypted data that form an append-only database of transactions. Each block contains a record of transactions among multiple parties, each of which has real-time access to a shared database. As a block is encrypted with a link to the previous block, it cannot be altered, except by unencrypting and amending all subsequent blocks.

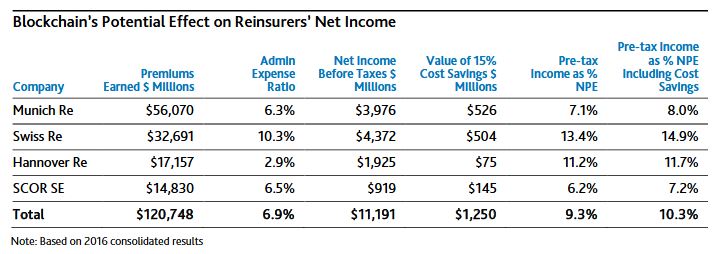

PricewaterhouseCoopers estimates that blockchain technology will reduce reinsurer non-commission expenses by 15%-25%, including data processing efficiencies and reduced chance of overpayment because of data errors. For illustrative purposes, the exhibit below shows the potential effect on annual pre-tax earnings for some of the world’s top reinsurance companies, all of which are included in the B3i consortium. We also expect the technology to decrease the time between primary insurance claim and reinsurance reimbursement, a credit positive for primary insurers.

B3i launched in October 2016 with five original members, including Aegon N.V., Allianz SE, Munich Reinsurance Company, Swiss Reinsurance Company Ltd. and Zurich Insurance Company Ltd. It now has 15 members. Beta testing for B3i’s program is scheduled for October and is open to any insurers, reinsurers or brokers that wish to pilot the technology, regardless of their membership status in the consortium. Although the initial pilot was for property-catastrophe excess-of-loss policies, B3i plans to broaden its application to other types of reinsurance, catastrophe bonds and other insurance- linked securities.