We had a technical issue with the DFA Blog this morning, thanks to a faulty WordPress update. As a result our recent posts were not syndicated through the normal channels. Having fixed the problem, here is a quick summary of what you may have missed.

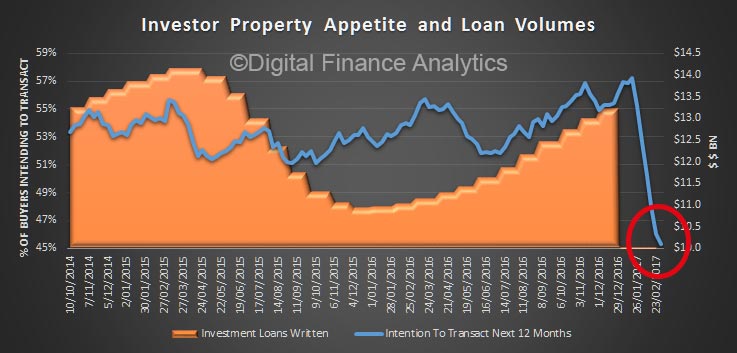

Majority of brokers expect more out-of-cycle rate hikes

A recent survey has revealed that 85 per cent of brokers believe there are more out-of-cycle rate hikes in the pipeline, which will create challenges for existing mortgage holders.

APRA Looking At Capital Ratios For Mortgages Wayne Byres speech “Fortis Fortuna Adiuvat: Fortune Favours the strong”, as Chairman of APRA, at the AFR Banking & Wealth Summit, makes two significant points.

First, there are elevated risks in the residential lending sector (even after the recent tactical announcements on interest only loans). Banks remain highly leveraged businesses.

Second, despite the delays from Basel, APRA will consult this year on potential changes to the capital ratios, reflecting the Australian Banks’ focus on mortgage lending and the need to be “unquestionably strong”.

CUA will temporarily pause accepting investor lending applications

Credit Union Australia (CUA) has said it will temporarily pause accepting investor lending applications until further notice, including applicants refinancing from other financial institutions.

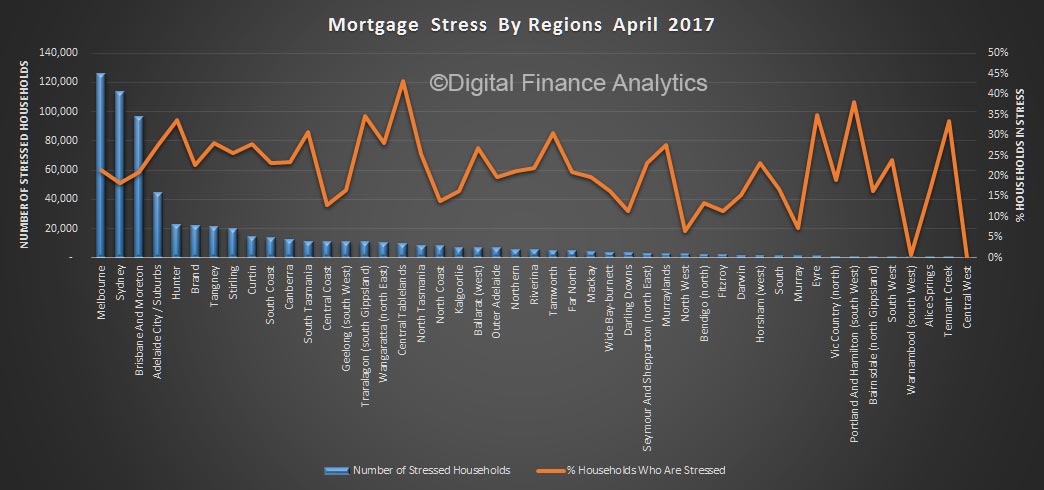

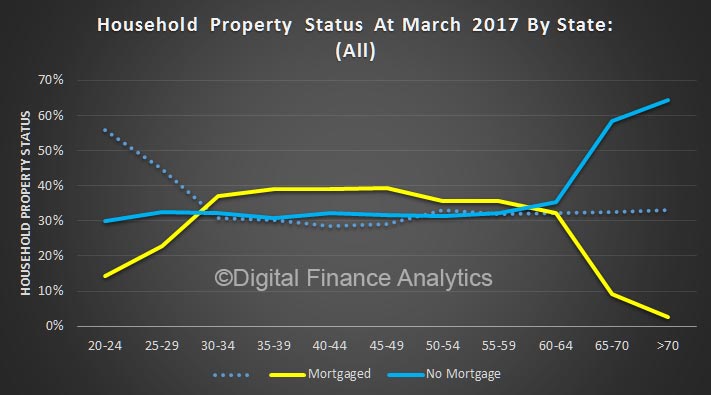

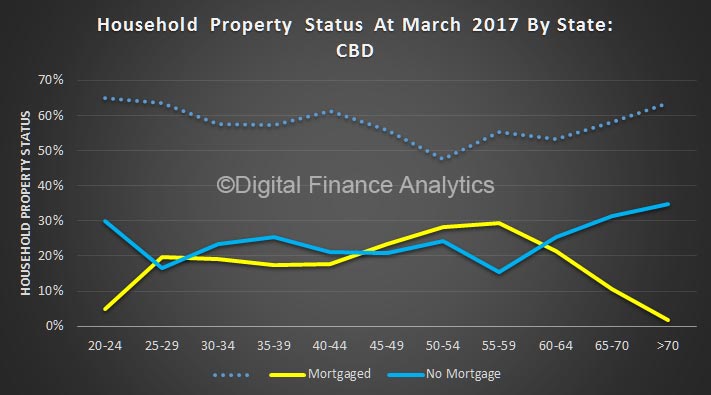

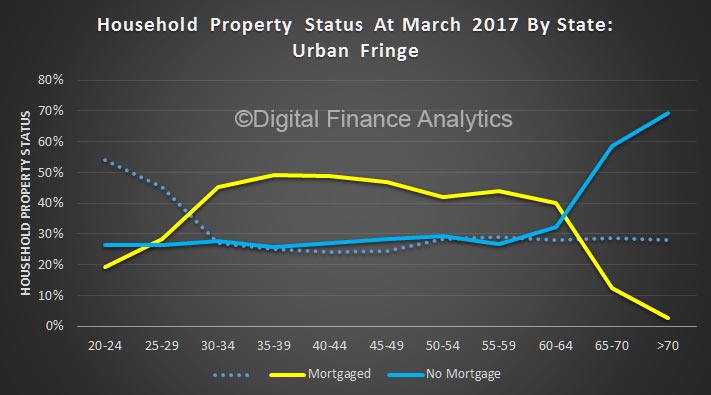

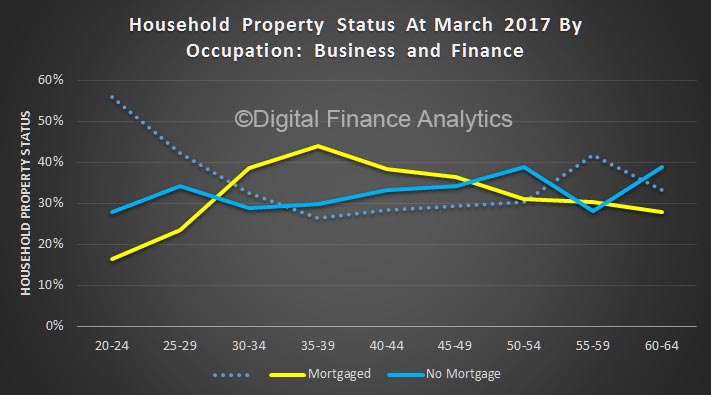

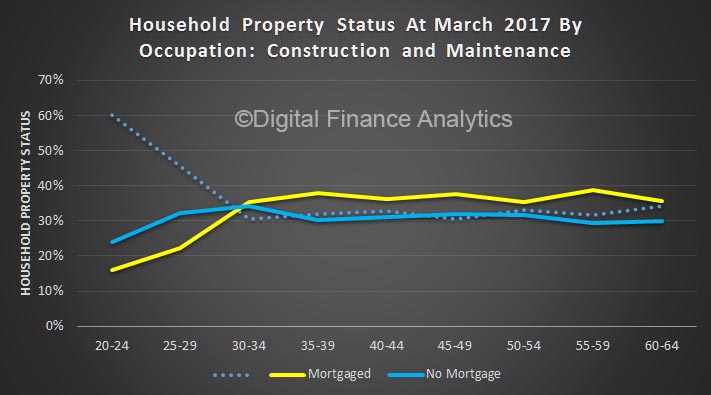

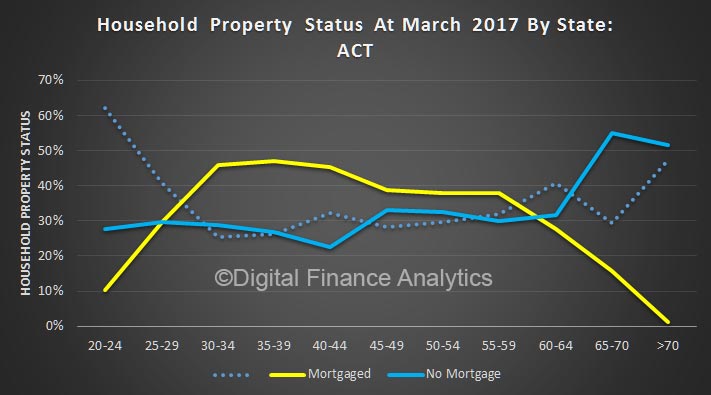

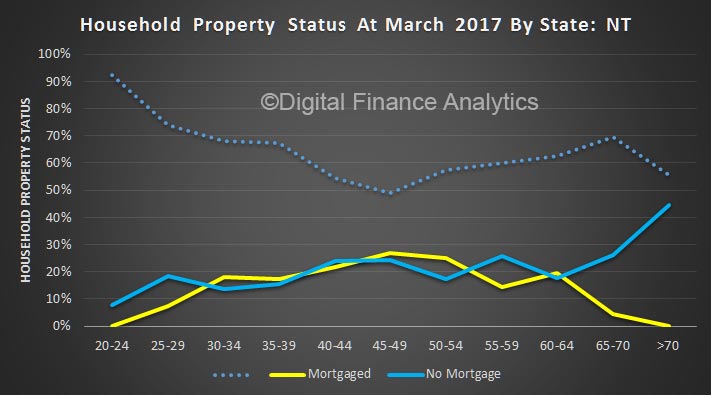

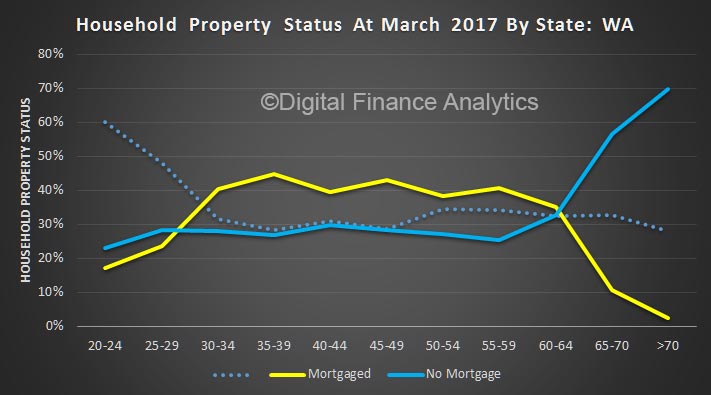

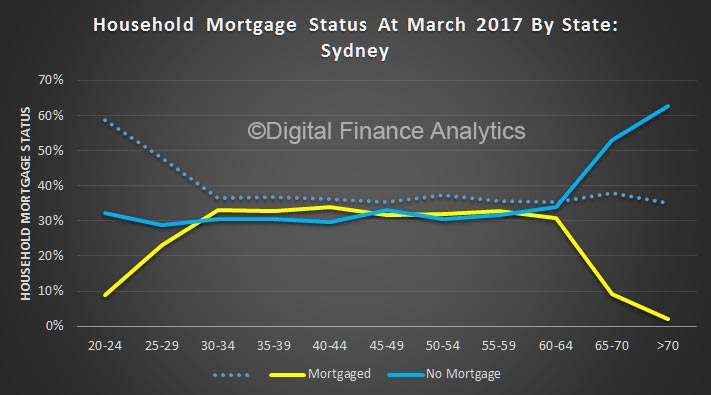

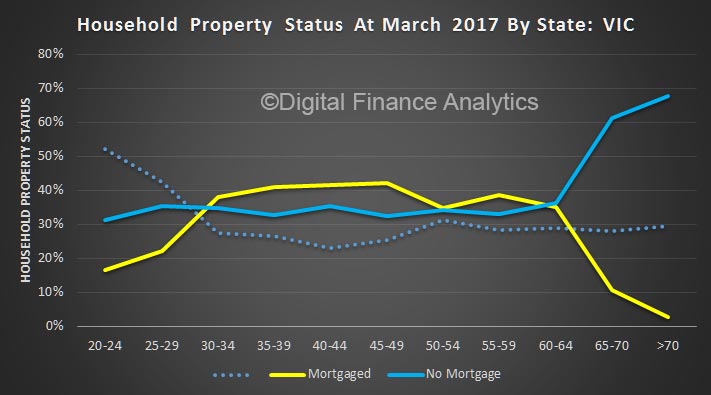

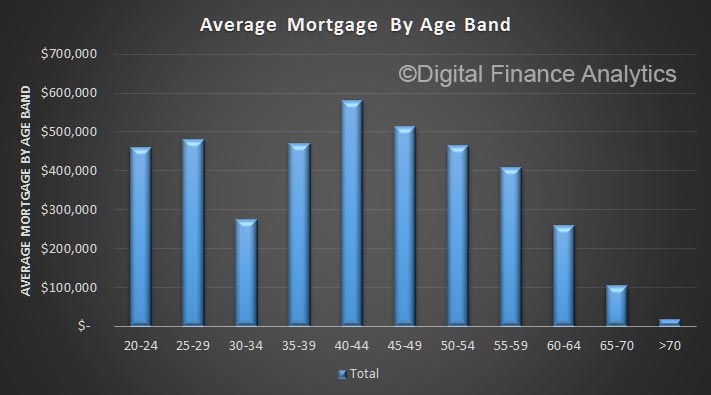

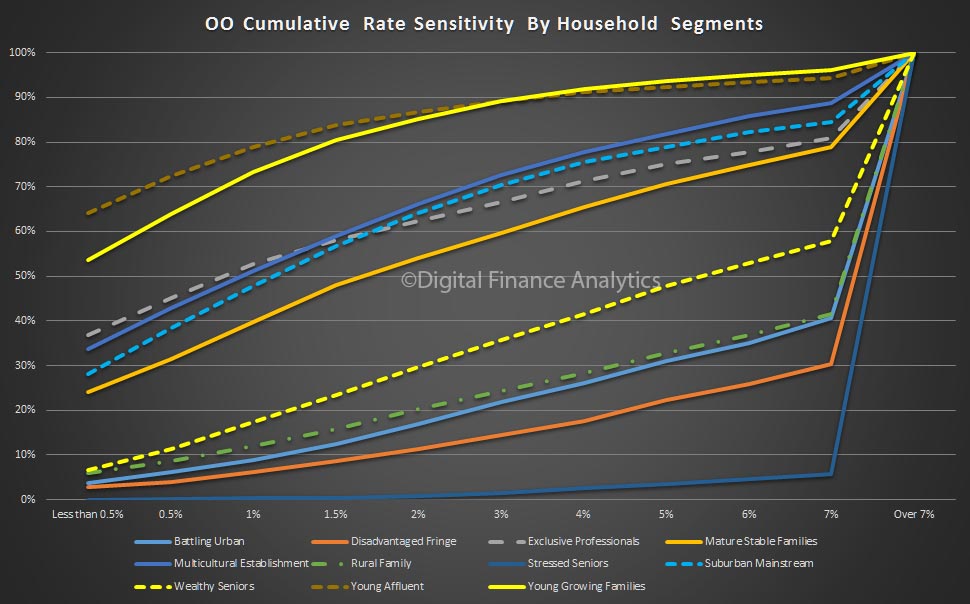

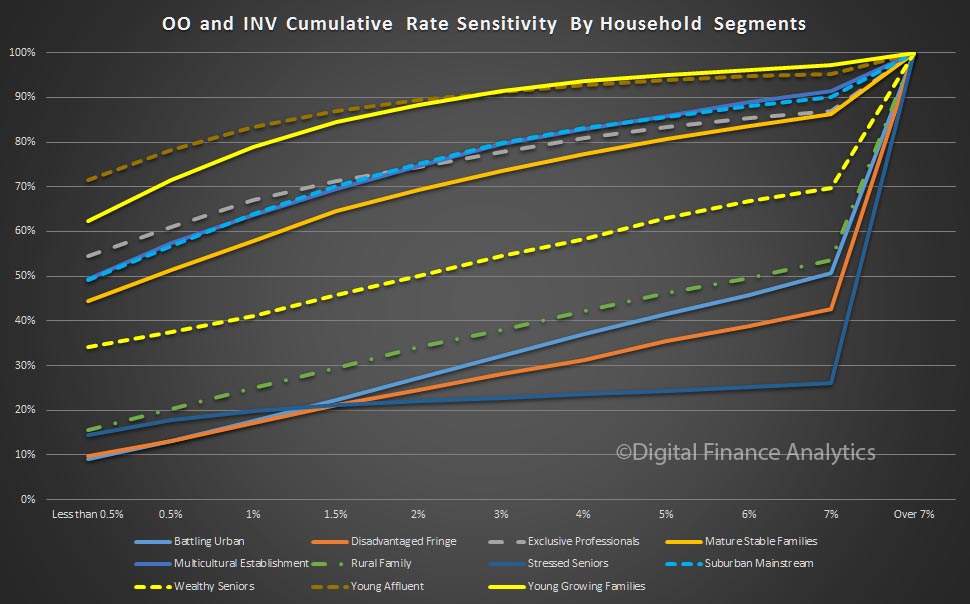

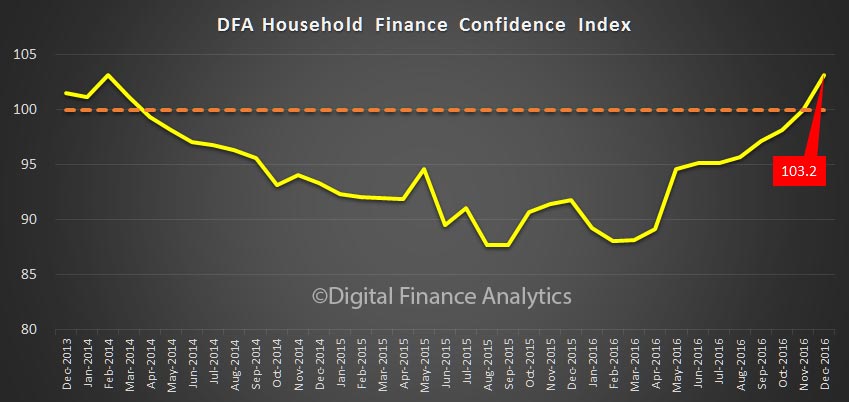

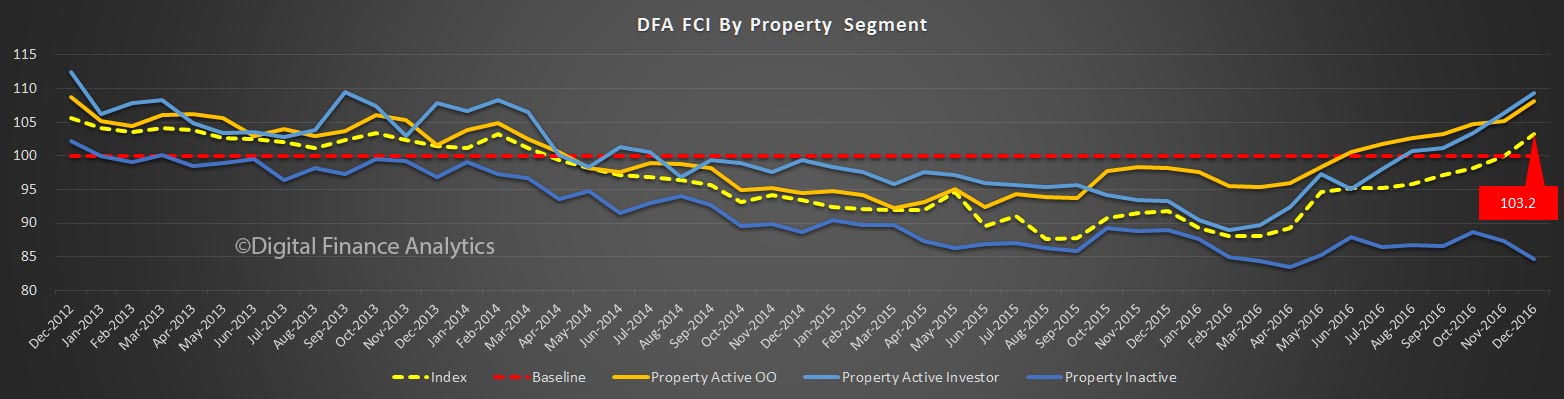

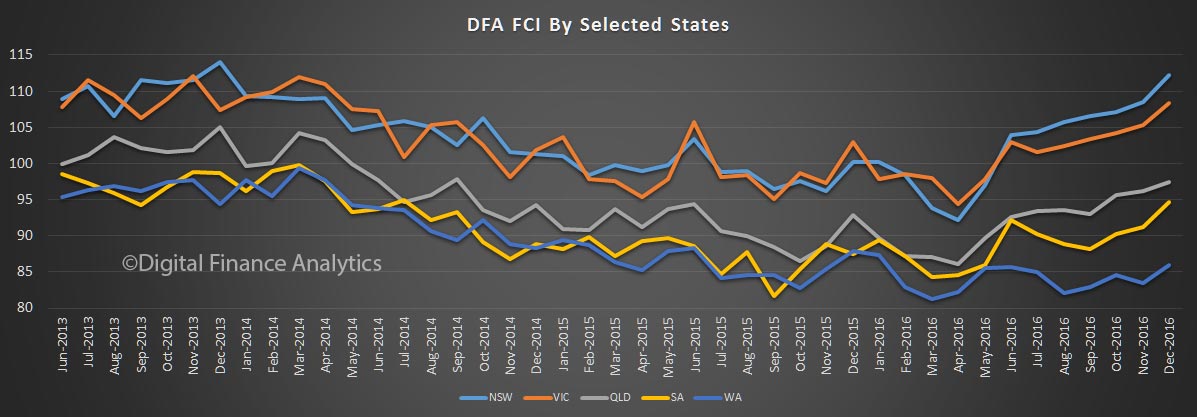

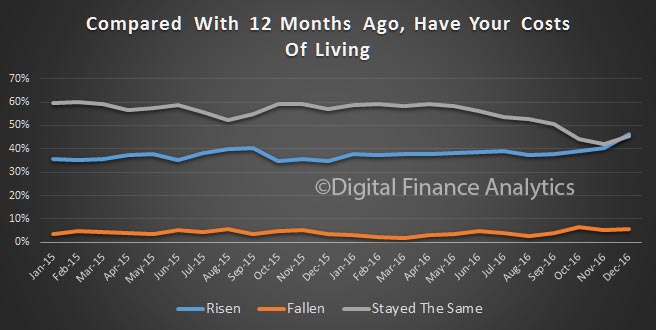

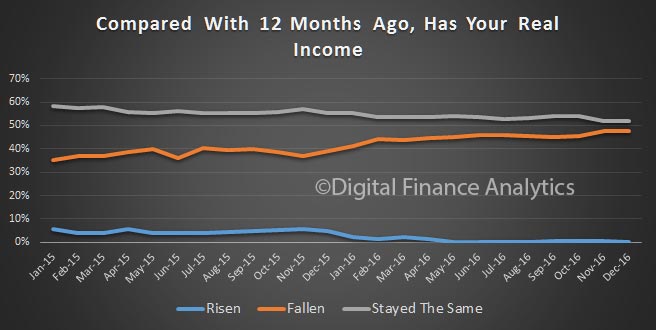

Property And Household Financial Footprints

Data from the Digital Finance Analytics Core Market Model tells an interesting story when we look at households dependence on wealth from property.

To illustrate the point, here are three charts, looking at different household groups.

We believe normal service has now resumed.