The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Note at 4:25 Nasdaq was 7,845.73 (not what I said in the recording).

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Note at 4:25 Nasdaq was 7,845.73 (not what I said in the recording).

I discuss how Ireland navigated their financial crisis a decade ago with Eddie Hobbs, the financial writer, adviser and. broadcaster, who lived through the crash and commented on the events in Ireland.

He wrote and presented a programme on state broadcaster RTE entitled Rip-Off Republic in 2005.

Specifically we discuss how Australia should be preparing…. now….

NAB says that an additional charge of $525 million after tax ($749 million before tax) relating to its customer remediation programme. As a result 1H19 cash earnings will drop by around $325 million and earning from discontinued operations by $200 million.

They say they have made around 360,000 payments to customers with a total valuer of $145 million, and the remediation team is building from 350 to around 500 across NAB.

Of the 1H19 charges, 90% relate to wealth, the remainder banking. IN combination with provisions raised in 2H18, total provisions for customer related remediation to 31 Match 2019 is $1,102 million.

The items responsible for this include:

These costs are to be held below the line as it were, but clearly investors and potentially customers will have to pay for this litany of poor practice.

It begs the question, can the NAB behaviourial norms be turned around? And at what cost?

The major banks have seen their reputations significantly downgraded in an annual perception survey, with AMP placing last out of 60 Australian companies.

The Reputation Institute’s Australia RepTrak 2019 list examined 60 of the top revenue making Australian firms, which saw all of the big four banks and AMP ranked within the bottom ten.

The list was based on a survey with around 10,000 respondents giving ratings across factors such as trust and respect to generate overall reputation, in addition to seven parameters: products/services, innovation, workplace, citizenship, governance, leadership and performance.

AMP scored the lowest out of any company across all seven dimensions, dropping by 18 rankings from 2018.

NAB was the next lowest bank, falling at 58th place and having fallen 15 rankings from the year before.

Commonwealth Bank of Australia remained at its spot of 57th, while Westpac fell nine places to 55th.

ANZ fared the best of the big four, coming in at 51st, having fallen 16 places.

“In the past 12 months we’ve seen many issues raised about corporate behaviour and consumer trust,” Oliver Freedman, vice president and market leader, Reputation Institute said.

“As a result, the reputations of our major banks and some financial services organisations have taken a major hit.”

Meanwhile, Bendigo and Adelaide Bank rose seven places to 11th, which Mr Freedman said was due to a strong performance in the individual measurements of citizenship and governance.

“This proves that you can be a bank and still have a strong reputation if you are focused on reputation drivers that resonate with customers and increase trust,” he added.

Macquarie on the other hand came in at 42nd, down five places, as Allianz fell seven places from the year before to 37th.

New addition to the list Rest Super ranked 21st,while the Reserve Bank of Australia placed 18th, having risen by eight places.

AustralianSuper was down eight places to 15th.

“The banking sector has a long road to recovery and could learn a lot from those with consistently strong rankings, like Qantas and Air New Zealand,” Mr Freedman said.

The Australian Prudential Regulation Authority (APRA) has released details on the future role and use of enforcement activities in achieving its prudential objectives.

Guiding principals include “risk-based”, “forward-looking”, “outcomes-based” and deterrence impact. Of course the question is, will it really make any difference? Here is the release.

APRA’s new Enforcement Approach, published today, sets out how APRA will approach the use of its enforcement powers to prevent and address serious prudential risks, and to hold entities and individuals to account.

The new Enforcement Approach is founded on the results of its Enforcement Review, which has also been published today. The Review, conducted by APRA Deputy Chair John Lonsdale, made seven recommendations designed to help APRA better leverage its enforcement powers to achieve sound prudential outcomes.

The APRA Members formally commissioned the Enforcement Review last November in response to a range of developments, including the creation of the Banking Executive Accountability Regime, the Prudential Inquiry into Commonwealth Bank of Australia, evidence presented to the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, and proposals to give APRA expanded enforcement powers, particularly in superannuation. Mr Lonsdale led the Review, supported by a secretariat within APRA. Mr Lonsdale also utilised an Independent Advisory Panel comprising Dr Robert Austin, ACCC Commissioner Sarah Court and Professor Dimity Kingsford Smith to provide external perspectives and advice.

While APRA’s appetite for taking enforcement action is closely linked to a number of other components of its supervisory approach, the Review was focused on enforcement activity and not APRA’s wider operations

APRA Chair Wayne Byres said APRA would implement all the recommendations, including:

Mr Lonsdale said the Review found APRA had, on the whole, performed well in its primary role of protecting the soundness and stability of institutions. But he said APRA could achieve better outcomes in the future by taking stronger action earlier where entities were not cooperative or open, and by being more willing to set public examples.

“APRA’s strong focus on financial risk has ensured the ongoing stability of Australia’s financial system, even during periods of financial and market stress, and protected the interests of bank depositors, insurance policyholders and superannuation members. But to remain effective, we must continue to evolve and improve, especially in response to the ways in which non-financial risks, such as culture, can impact on prudential outcomes.

“The recommendations of the Review will still mean that APRA as a safety regulator remains focused on preventing harm with the use of non-formal supervisory tools. However, APRA will be more willing to use the full range of its formal powers – such as direction powers and licence conditions – to achieve prudential outcomes and deter unacceptable practices,” Mr Lonsdale said.

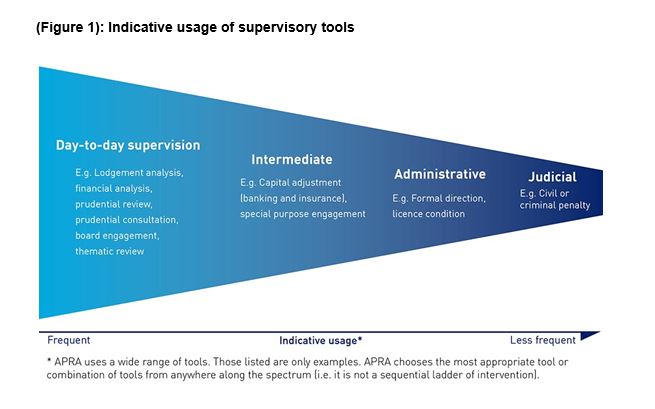

Mr Byres thanked Mr Lonsdale and the APRA Review team for delivering a valuable piece of work that would sharpen APRA’s ability to hold entities and their leaders to account. He said enforcement activity is not intended to be a separate or stand-alone function, but rather a set of tools that APRA supervisors would use more actively, particularly in the case of uncooperative institutions. (See Figure 1)

“Having joined APRA only last October, John brought a fresh set of eyes to the task of examining APRA’s historical approach to enforcement. The Review acknowledges that as a supervision-led prudential regulator, APRA’s primary focus will always be on resolving issues before they cause problems for depositors, insurance policyholders and superannuation members, rather than relying on backward-looking actions after harm has occurred. In most cases, we will continue to achieve this through non-formal tools.

“However, formal enforcement is an important weapon in our armoury when non-formal approaches are not delivering prudential outcomes. Particularly as our powers have recently been strengthened in a number of areas, the new Enforcement Approach will ensure we make use of those powers as the Parliament intended. That means that in future, APRA will be less patient with the time taken by uncooperative entities to remediate issues, more forceful in expressing specific expectations, and prepared to set examples using public enforcement to achieve general deterrence.

“With the release of APRA’s revised Enforcement Approach today, the new enforcement appetite comes into effect immediately,” Mr Byres said.

Mr Byres indicated support for the recommendations on legislative change, and that these would be referred to the Government for its consideration. He also welcomed the recent passage of the Treasury Laws Amendment (Improving Accountability and Member Outcomes in Superannuation Measures No 1) Bill 2019 as a useful complement to APRA’s renewed enforcement appetite.

The Panel, led by Graeme Samuel, currently undertaking a Capability Review of APRA will take into account APRA’s new Enforcement Approach in its work.

The Final Report of the Review and APRA’s Enforcement Approach are available on APRA’s website at: https://www.apra.gov.au/enforcement.

Following an ASIC investigation, Citigroup will refund over $3 million to 114 retail customers for losses arising out of structured product investments offered by Citigroup between 2013 and 2017. Citigroup will also write to over 1000 customers remaining in the products to provide them an opportunity to exit early without cost.

ASIC investigated Citigroup’s sale and provision of general advice to customers for fixed coupon structured products, which are complex, capital at risk products tied to the performance of reference shares.

ASIC was concerned that while Citigroup considered its financial advisers to be providing general advice, elements of its practice may have led some customers to believe that Citigroup was providing personal advice.

Citigroup’s practices included its advisers asking customers about their personal circumstances, such as their tolerance for risk, and providing financial education about benefits and risks to customers who had no previous experience of investing in structured products. Financial advisers have higher obligations and disclosure requirements when providing personal advice.

From 1 January 2018, as a result of ASIC’s investigation, Citigroup ceased selling structured products to retails clients under a general advice model.

Citigroup will shortly start contacting affected customers. The remediation will be completed by 10 September 2019, will be independently assured and Citigroup will report to ASIC once the process is complete.

ASIC has warned Australian financial services licensees that offer over-the-counter derivatives to retail investors located overseas could be breaking laws abroad, with Chinese authorities having alerted the watchdog that some online platforms have engaged in illegal activity, via InvestorDaily.

Regulators in jurisdictions including Europe, Japan, North America and China have restricted or prohibited the provision of certain OTC derivatives, such as binary options, margin foreign exchange and other contracts for difference (CFDs) to mitigate harm to retail investors.

ASIC has expressed concern that some OTC derivative issuers that hold AFSLs may be marketing or soliciting overseas clients to open accounts with Australia-based licensees on the basis of avoiding overseas intervention measures.

The regulator said is it considering whether breaching overseas laws is consistent with obligations under Australian law to provide services ‘efficiently, honestly and fairly’.

ASIC is also considering whether it will see AFSL holders could be making misleading or deceptive statements about the scope or effect of their license.

“AFS licensees who break the law in overseas jurisdictions, or who mislead retail investors about their services undermine the integrity of the Australian licensing regime,” commissioner Cathie Armour said.

“ASIC will not tolerate that conduct.”

Chinese authorities have already informed ASIC that “some online platforms are illegally engaged in forex margin trading activities”.

Under Chinese law, no institution or agency has approval to carry out margin foreign exchange trading.

Temporary product intervention measures have also been extended in Europe by the European Securities and Markets Authority, with authorities in the UK and Germany introducing permanent measures including anti-avoidance provisions.

“AFS licensees offering OTC derivatives to overseas retail clients should, as a matter of priority, seek advice on the legality of their offerings to these clients,” commissioner Armour said.

“Any non-compliant activities should cease immediately and be notified to ASIC and the relevant overseas authorities.”

ASIC has released KordaMentha Forensic’s final report on CBA’s advice compensation program under its additional licence conditions.

CBA has offered approximately $9.3 million to customers whose advice has been reviewed as a result of the licence conditions imposed by ASIC in August 2014.

ASIC had imposed additional conditions on the Australian financial services (AFS) licences of CBA’s Commonwealth Financial Planning Ltd and Financial Wisdom Ltd with the consent of the licensees in August 2014, and appointed KordaMentha Forensic as the independent expert to monitor the licensees’ compliance with the additional licence conditions.

ASIC took this action because the licensees did not apply review and remediation processes consistently to customers of 15 financial advisers, disadvantaging some customers. The additional licence conditions required that CBA offer compensation for inappropriate advice that caused financial loss (where applicable) and offer affected customers up to $5,000 to get independent advice from an accountant, financial adviser or lawyer.

KordaMentha Forensic has produced five reports since the licence conditions took effect. In the first report, the Comparison Report, KordaMentha Forensic identified inconsistencies in treatment of clients and required the licensees to correct the inconsistencies for approximately 2,740 customers.

In the second report, the Identification Report, KordaMentha Forensic found that the licensees had taken reasonable steps in 2012 to identify which clients of the 15 advisers had to be included in the compensation program.

KordaMentha Forensic also found that the licensees had taken reasonable steps to identify other potentially high-risk advisers, but that the licensees had not adequately reviewed advice given by 17 of those advisers. To address this, KordaMentha Forensic prescribed the scope of the additional reviews (of the 17 advisers) that the licensees had to undertake.

KordaMentha then produced three additional reports describing the licensees’ compliance with the conditions, the additional steps that the licensees were required to take, and the compensation outcomes. Compliance Report Parts 1 & 2 assessed the steps taken by the licensees to communicate with and compensate (where applicable) customers of 15 former advisers for advice provided between 2003 and 2012.

Compliance Report Part 3 described the licensees’ review of the 17 potentially high-risk advisers and KordaMentha Forensic’s conclusion that the licensees should apply the compensation program to customers of five of those advisers.

In the final report, Compliance Report Part 4, published today, KordaMentha Forensic covers the last of CBA’s advice compensation program under the licence conditions. The report states that CBA has offered a further $2.3 million to 232 clients of the five advisers. This is in addition to:

This means that CBA has offered approximately $9.3 million to customers whose advice has been reviewed as a result of the licence conditions imposed by ASIC in August 2014.

The latest amendments passed into law last week extends the capital raising capabilities of mutuls in Australia, via mutual capital instruments (MCIs), which Moody’s rates as “credit positive”.

However, we are concerned by the extension of “financialisation” into the mutual sector, the potential higher risks it introduces as players compete for returns to investors, and the complexity of the financial markets they have to engage in. This could be a disaster.

Frankly, this just continues the journey away from meat and potato banking and is a further illustration of the myopic views of the regulators, especially APRA.

Rather than extending these additional capital channels, we need banking structural reform to contain the over-risky sector. This is the wrong strategy at the wrong time (especially as the housing sector tanks).

Anyhow, this is what Moody said:

On 4 April, Australia’s parliament passed the Treasury Laws Amendment (Mutual Reforms) Bill 2019, which amends the Corporations Act 2001 to allow mutually owned institutions to issue capital instruments. The development is credit positive for mutuals because it will enhance their ability to support growth, invest in technology innovation and, over time, will also strengthen their competitiveness.

In particular, the amended Act introduces a definition of a “mutual entity;” clarifies that demutualisation rules can only be triggered by an intended demutualisation and not by other acts such as capital raising; and creates mutual capital instruments (MCIs) that are specific to the mutual industry to raise equity capital.

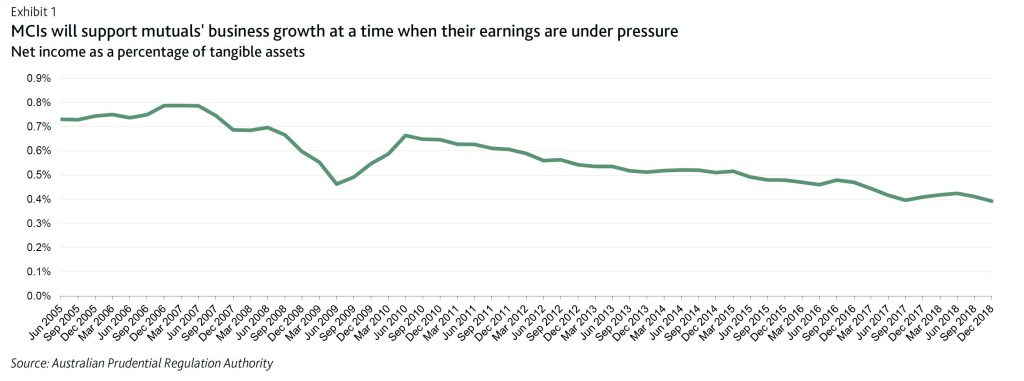

MCIs will provide mutuals with an additional capital channel to respond to growth opportunities, supplementing the retained earnings they have relied on to date. This additional capital channel is particularly important for mutual authorised deposit-taking institutions (mutual ADIs, which include mutual banks, building societies and credit unions) at a time when their profitability is under pressure. Pressure on profitability stems from competition for lower-risk owner-occupier mortgages with principal and interest repayments, the mutuals’ core products. This elevated competition stems from a number of factors including reduced overall loan growth; a reduced demand for investor mortgage loans in the face of potential changes to negative gearing and capital gains taxes; and tightened underwriting criteria at the major commercial banks as a result of public scrutiny during Australia’s Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

Additional capital options will also help mutual ADIs build the scale and efficiency they need for technology investment, which is particularly important at a time when banking services are rapidly becoming technology-based. Compared with mutual ADIs, the large commercial banks have more resources to develop or acquire innovative products, digitise processes and integrate new technologies into their business models. Technology-driven financial firms (fintechs) are seeking entry to banking, while the Australian Prudential Regulation Authority (APRA) has established a framework that allows new entrants to begin operating at an earlier stage in their licensing process than previously. These new entrants are currently small and subject to regulatory constraints in taking deposits

and making loans. In most cases they have not yet built up a retail customer base of meaningful size. However, they could grow to challenge incumbents, particularly small-scale ones like the mutual ADIs, over time.

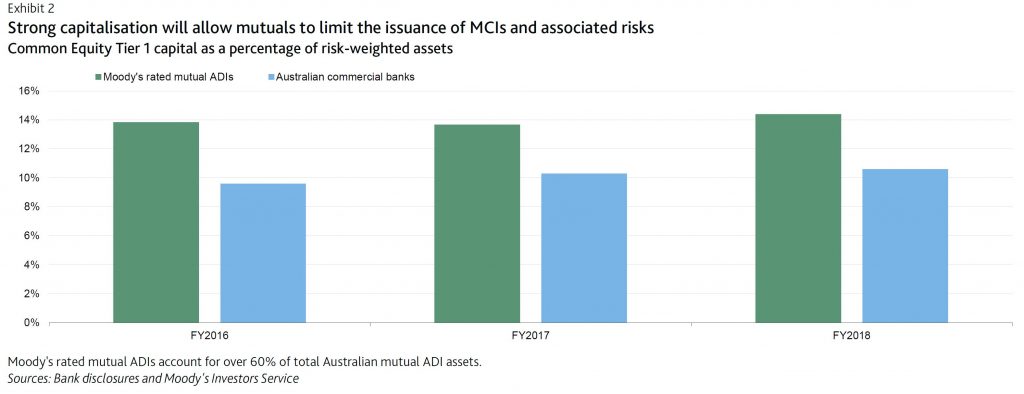

We do not expect mutual ADIs to swiftly ramp up their issuance of MCIs because their already-strong capitalisation and the current low loan growth environment are likely to reduce their need for additional capital. Mutual ADIs’ average Common Equity Tier 1 (CET1) capital ratio is well above that of the major commercial banks, which is itself strong by international standards. Moreover, APRA has set a 25% cap on the inclusion of MCIs in CET1 capital and has also capped the annual distribution of profit to holders of MCIs at 50% of a mutual institution’s net profit after tax for the year in question.

The prospect that the issuance of MCIs will remain limited will reduce the risk that mutual ADIs will significantly increase their risk profiles in an attempt to generate greater dividend returns for MCI holders. Mutuals will need time to amend their constitutions and build market recognition for MCIs. The experience of mutual banking peers in the UK also suggests that the process will be gradual. In the UK, mutuals have been allowed to issue core capital deferred shares, similar to MCIs, under the Building Societies (Core Capital Deferred Shares) Regulations 2013, but few have done so to date. We expect that Australian mutual ADIs that already have a strong investor base in the debt market to be in a better position to issue MCIs.

Industry insiders have revealed why banks are distancing themselves from wealth management and how their actions will reshape the Australian financial services sector; via InvestorDaily.

There are a number of reasons why the big four have decided, to varying degrees, to put a ‘for sale’ sign on their wealth management businesses.

Some major bank chief executives have run a ruler over their advice businesses and seen poorly performing divisions that just don’t provide enough margin for the group’s bottom line.

Others, like Westpac CEO Brian Hartzer, have seen the “writing on the wall” and the mountain of increasing compliance that must be scaled to make advice operational, let alone turn a profit.

But it may also have been a strategic play based on negative sentiment, bad press and the misguided belief that commissioner Hayne would propose an end to vertically integrated wealth models.

“What it looks like the banks have done in most cases, or in some cases, is they’ve picked up their vertically integrated business, which consist of advice and other products, and have looked to distance themselves from that by either demerging or selling the wealth business,” Lifespan Financial Planning CEO Eugene Ardino said.

Speaking exclusively on the Investor Daily Live webcast on Wednesday (3 April), the dealer group boss said the banks aren’t actually dismantling their conflicted businesses – they’re selling them as bundled, vertically integrated models where product and distribution sit under the same roof.

“That’s not dismantling vertical integration. That’s really them trying to distance themselves from wealth management. Whether that now goes ahead in some cases remains to be seen,” he said.

“Perhaps what could have happened is some sort of recommendation around how to limit vertical integration or how to control it.

“The issue you have is when you take a business that’s focused on sales and that business takes over as the dominant force in a company that also provides advice, then sales wins. I think that’s natural. Perhaps if they had started there, that could have led to some moderation of vertical integration.”

The royal commission hearings, more than anything, were a targeted attack on the sales culture of large financial institutions, many of which repeatedly defended their models as profit-making businesses, often beholden to shareholders.

“In product businesses, their job is to sell. That’s fine. There’s nothing wrong with that. But if you’re putting an adviser hat on, there needs to be some separation. That’s an issue of culture,” Mr Ardino said.

I haven’t seen some of the employment contracts of the advisers from some of the groups that got into trouble, but I would venture a guess that a lot of their KPIs talk about new business rather than retaining business and servicing clients.”

Fellow panellist and Thomson Reuters APAC bureau chief Nathan Lynch said that despite Hayne’s failure to propose banning vertical integration in wealth management, the model will ultimately be dismantled by market forces.

“Hayne points out that a lot of the dismantling of the vertically integrated model comes down to the fact that it’s just not profitable. You have an environment where vertical integration will be dismantled to some extent by competitive forces and by technology,” he said.

“Servicing the vast majority of client is going to become very difficult. Most businesses are starting to pivot to the high end. I think we need to view technology in advice as a positive, as an enabler.”