Putting together data from the recent ABS releases, we can view some important data which shows that today Banks in Australia are deeper into property than ever they have been. As a result they are more leveraged (thanks to capital adequacy rules) and more exposed if prices were to turn. Meantime, other classes of commercial lending continues to decline.

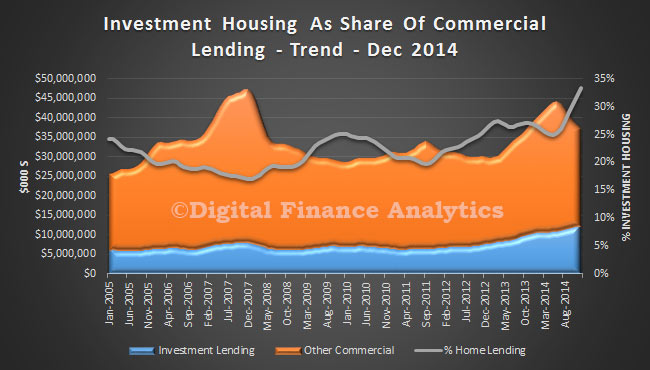

To show this, we look first at the share of commercial lending which is investment housing related. These are the monthly flows, not the overall stocks of loans on book. On latest trend data, around 33 per cent of monthly lending is for investment housing. Its normal range was 20-25 percent, but thanks to a spike in investment for housing, and a fall in other commercial lending categories it has broken above 30 percent. From a capital and risk perspective, lending for investment housing is adjudged as less risky than other commercial lending categories.

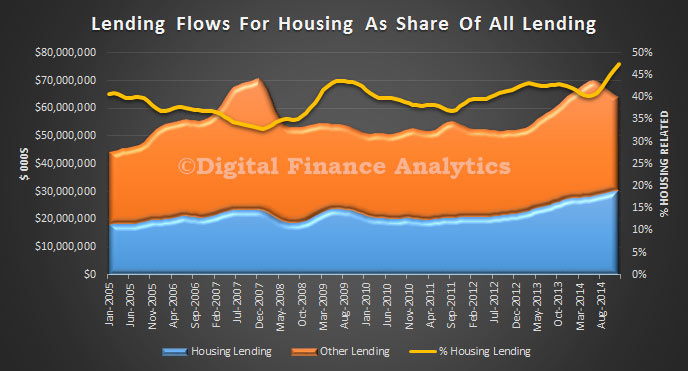

Now, lets look at all lending for property, including owner occupied lending, investment lending, and alterations, again from a flow perspective. Now we find that 47 per cent of all monthly flows are property related, again, higher than it has traditionally been.

Now, lets look at all lending for property, including owner occupied lending, investment lending, and alterations, again from a flow perspective. Now we find that 47 per cent of all monthly flows are property related, again, higher than it has traditionally been.

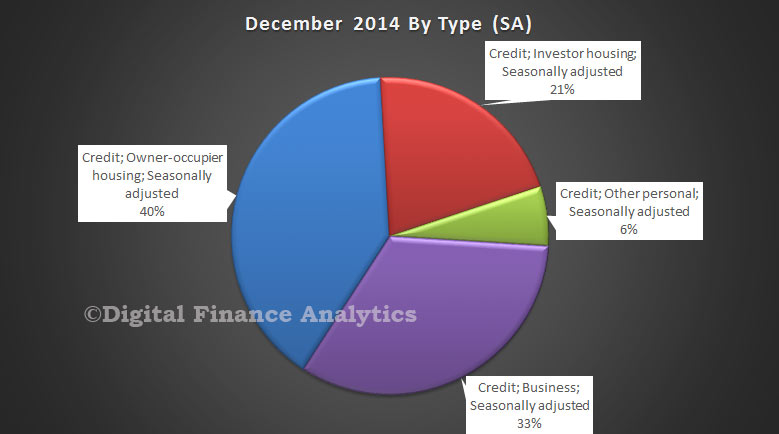

Finally, in our earlier analysis we highlighted the relative stock of different loan types. Overall, only 33% of all lending is productive finance for business purposes. Household and consumer debt continues to rise strongly. Housing Lending is driving the outcomes.

Finally, in our earlier analysis we highlighted the relative stock of different loan types. Overall, only 33% of all lending is productive finance for business purposes. Household and consumer debt continues to rise strongly. Housing Lending is driving the outcomes.

This is unproductive lending, simply feeding the debt beast, and inflating property to boot. It also means the banks have strong interests in keeping the beast fed, and the RBA, conscious of the need for financial stability, will continue to support the current mix. As Murray pointed out the government is guaranteeing the banks and if there was a failure the tax payer would pick up the tab.

One thought on “Banks More Leveraged Into Housing Than Ever”