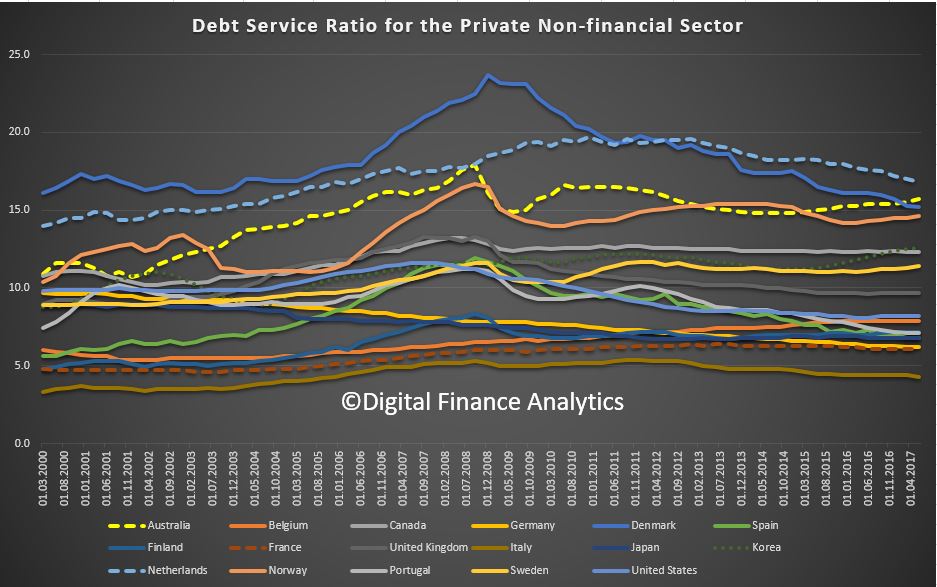

The Bank for International Settlements released their updated Debt Service Ratio (DSR) Benchmarks overnight. A high DSR has a strong negative impact on consumption and investment.

Australia (the yellow dashed line) is second highest after the Netherlands. We are above Norway and Denmark, and the trajectory continues higher. Further evidence that current regulatory settings in Australia are not correct. As the BIS said yesterday, such high debt is a significant structural risk to future prosperity.

The DSR reflects the share of income used to service debt and has been found to provide important information about financial-real interactions. For one, the DSR is a reliable early warning indicator for systemic banking crises.

The DSR reflects the share of income used to service debt and has been found to provide important information about financial-real interactions. For one, the DSR is a reliable early warning indicator for systemic banking crises.

The DSRs are constructed based primarily on data from the national accounts. The BIS publishes estimated debt service ratios (DSRs) for the household, the non-financial corporate and the total private non-financial sector (PNFS) using standardised data inputs for 17 countries.