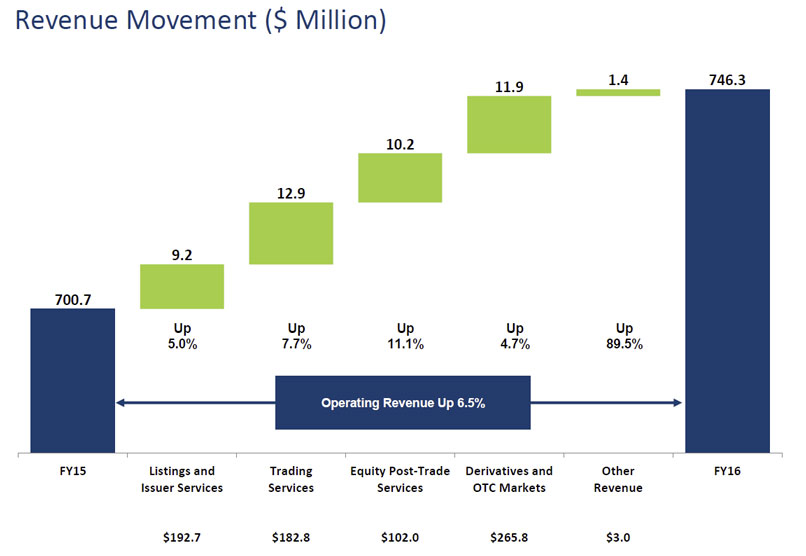

The ASX released their results for FY16, with revenue of $746.3m, up 6.5%, and Net Profit of $426.2m, up 5.7%.

Mr Rick Holliday-Smith, ASX Chairman, said: “ASX delivered strong financial results in FY16, with growth in all key business areas, supported by higher market activity. This was driven by a rise in secondary capital raisings within the financial sector and increased trading activity due to heightened volatility, particularly in the second half of the year, culminating in the surprise of Brexit. Revenue was up 6.5% to $746.3 million and profit after tax rose 5.7% to $426.2 million.

Mr Rick Holliday-Smith, ASX Chairman, said: “ASX delivered strong financial results in FY16, with growth in all key business areas, supported by higher market activity. This was driven by a rise in secondary capital raisings within the financial sector and increased trading activity due to heightened volatility, particularly in the second half of the year, culminating in the surprise of Brexit. Revenue was up 6.5% to $746.3 million and profit after tax rose 5.7% to $426.2 million.

“ASX continued to invest in the infrastructure critical to Australia’s financial markets throughout the period. This included successfully introducing T+2 settlement, significant progress on the delivery of a new futures trading platform, and the assessment of distributed ledger technology or ‘blockchain’ as a potential post-trade solution for the equity market. These initiatives aim to improve market efficiency and reduce risk and complexity for investors, intermediaries and other market stakeholders. They help keep Australia at the forefront globally of innovative market developments”.

ComputerWorld reported on the Blockchain initiatives.

ASX has completed the first phase of work on a potential blockchain-based replacement for its CHESS system, which providers clearing and settlement services.

The operator of the Australian Securities Exchange announced earlier this year that taken a stake in US company Digital Asset Holdings with an eye to potentially developing technology inspired by the distributed ledger that underpins the Bitcoin cryptocurrency.

“We’ve completed our initial analysis of the technology and have begun work on the next stage of this journey,” ASX CEO Dominic Stevens said today during a full year results presentation.

“We’ve made good progress” in exploring the use of distributed ledger technology over the past year, said deputy CEO Peter Hiom.

“The initial phase of development has been completed,” Hiom said. “We’ve increased our investment in Digital Asset Holdings and we have commenced the next development phase. Over the next 18 months ASX and Digital Asset Holdings will build an industrial strength platform that could be used as the basis to replace CHESS over the longer term.

“ASX is now commencing engagement with customers and stakeholders on the requirements for that platform, with a final decision by ASX on whether to use the technology being made later in FY18.”

Hiom said that there were some key differences between the “permissioned disturbed ledger technology” ASX is experimenting with and the public blockchains employed by cryptocurrencies.

“The main difference I want to highlight is public blockchains are operated largely in unregulated marketplaces where anyone can join and access those markets anonymously via a public, or unpermissioned, network,” he said.

“Network security is public to scrutiny and if compromised it could allow someone to anonymously and unilaterally transfer cryptocurrency on the public network. This is clearly unacceptable in the types of highly regulated markets within which the ASX operates.”

“Not withstanding this, the underlying blockchain technology has inspired new applications that can be tailored for use in highly regulated markets such as those operated by ASX,” he added. “It is the database architecture, or distributed ledger technology, which interests us.”

He said that ASX didn’t seek to change the existing regulatory framework it operates in.

“What we do change is the way that data is authenticated, authorised, accessed and stored,” Hiom said. “It is this that creates the single source of truth that could remove complexity and deliver significant benefits to the industry.”

The deputy CEO said that there had so far been no “red flags” around scalability or performance.

Read more: Blockchain is useful for a lot more than just BitcoinASX reported growth in its operating expenses for FY16 of 6.5 per cent to $170.6 million, which the company attributed in part to investment in its technology transformation program.

“We’re in the midst of a major transformation,” Stevens said. “Specifically we’re replacing or upgrading our trading, monitoring, risk and clearing systems, exploring post-trade innovation through the use of distributed ledger technology, [and] improving connectivity for our customers, here and abroad.”