ANZ’s IH17 result, announced today shows the benefit of the consolidation of the business, with more focus on growth in Australia and New Zealand. Profit is up, despite a drop in Group Net Interest Margin, with support from loan and deposit growth, and lower provisions. All well and good so long as the local economy performs!

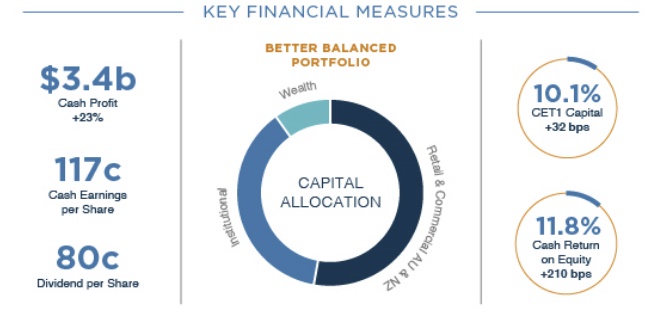

ANZ today announced a Statutory Profit after tax for the Half Year ended 31 March 2017 of $2.9 billion up 6% and a Cash Profit1 of $3.4 billion up 23% on the prior comparable period (PCP). Cash profit was up 23%.

Group net interest margin fell 7 basis points from 1H16 to 2%.

Group net interest margin fell 7 basis points from 1H16 to 2%.

ANZ’s Common Equity Tier 1 Capital Ratio was 10.1% at 31 March 2017 up 52 basis points (bps) from 30 September 2016. (15.2% on an

Internationally Comparable basis). Return on Equity increased

210 bps to 11.8%.

The total provision charge of $720 million ($787 million individual provision charge and a $67 million collective provision release) equates to

a loss rate of 25 bps, a decline of 11 bps from the end of 2H16. Gross

impaired assets over the same period decreased 7% to $2.94 billion with

new impaired assets down 3%.

Strong organic capital generation performance saw Australian Prudential Regulation Authority (APRA) Common Equity Tier 1 capital ratio above 10% for the first time and Return on Equity increased materially for the

first time since 2010.

The Group has a strong funding and liquidity position with the Net Stable

Funding Ratio at 113% up 5% from 30 September 2016. The improvement

was largely attributable to strong Retail deposit growth in Australia.

The FY17 interim result reflects further benefits from a significant reshaping of the business driven by ANZ’s strategic focus to create a simpler, better capitalised and more balanced bank producing better outcomes for customers and shareholders.

The Interim Dividend of 80 cents per share fully franked, is the same as the Interim Dividend in FY16, reflecting a payout ratio of 69% (Pro Forma 65%).

- Over 50% of Group Capital is now allocated to the Retail and

Commercial businesses in Australia and New Zealand up from 44%. - Capital reallocation is evidenced in a $7b net decrease in Credit

Risk Weighted Assets (CRWA) from the end of FY16 on a constant

currency basis. This includes a $2b increase in Retail and

Commercial offsetting a reduction in Institutional CRWAs of $8b. - The Group CET1 ratio was 10.1% at 31 March; net organic capital

generation of 119 bps in the half was primarily driven by earnings

growth along with RWA reduction. - Announced the sale of the Retail/Wealth businesses in six Asian

countries, UDC Finance in New Zealand and ANZ’s 20% holding in

Shanghai Rural Commercial Bank. Disposal of non-core assets will

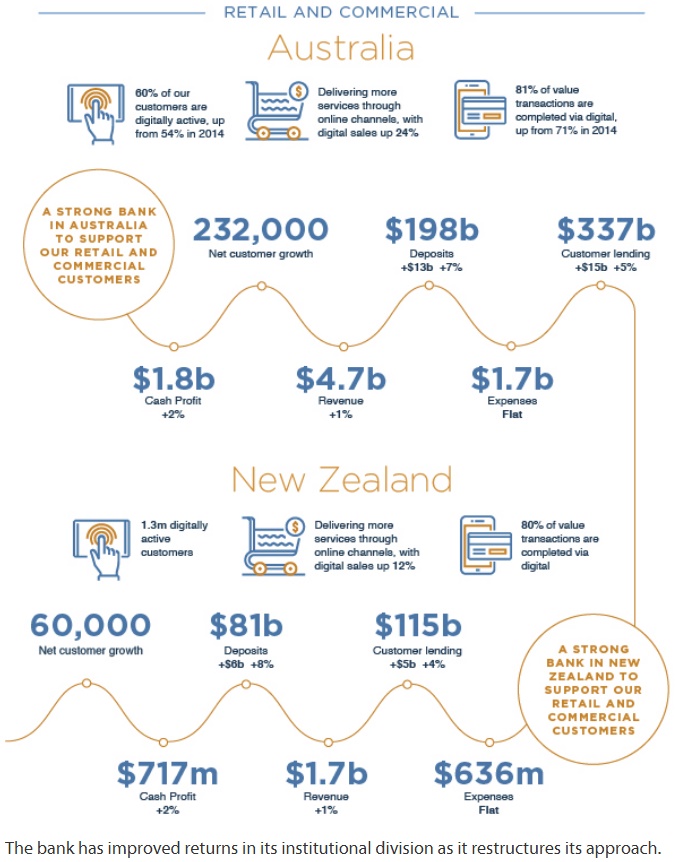

deliver an additional 65 – 70 bps of capital by the end of FY17. - Strong customer deposit growth in Australia (up 7%) and New

Zealand Retail and Commercial (up 8%). - Australia home lending up 5%, maintained #3 market share while

improving the portfolio mix, #1 market share in New Zealand.

Small business lending in Australia up 4%, New Zealand up 8%. - The Institutional Payments and Cash Management business

increased revenue 3%. - ANZ has a clear leadership position in Australia and New Zealand

Lead Institutional Bank Penetration and was a Top 4 Corporate Bank

in Asia for the fifth successive year. - New balanced scorecard remuneration structure introduced for

Australian front line Retail Banking staff, focussed largely on

customer service outcomes. - Improving the customer experience – introduced card replacement

for lost or stolen cards within 15 minutes via the digital wallet.

60% of customers in Australia and 64% in New Zealand are now

digitally active. - Australia Retail and Commercial customer numbers up 4%; 60% of

Retail customers holding multiple products. Service improvements

along with products like ApplePay have driven net customer growth.

Launch of Home Loan Online Application in Australia driving easier

loan approvals. Expanded support to Small Business customers in

Australia; new banker tools accelerate origination and assessment.

The adoption of Agile at scale continues, with planning is already underway to broaden its roll out in early 2018.