Today we look at a Interest Rate Sensitivity – a specific slice of data from our household surveys which we use to drive the mortgage stress data series, as we discussed recently.

Using data from our surveys we are able to estimate the amount of headroom households would have if mortgage interest rates were to rise. We are expecting rises through 2017.

We look at a range of scenarios, and as rates rise estimate the “pain point” for specific households, taking into account their other commitments, income, type of loan and mortgage repayments. Today we look at owner occupied loans.

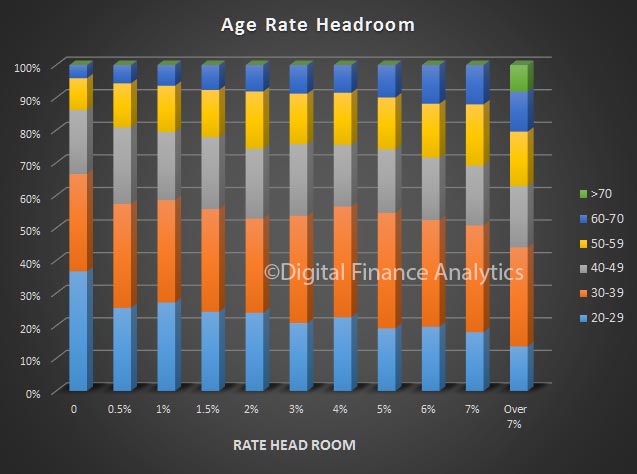

Looking at sensitivity by age of household, more than 65% of those under 40 years with a mortgage would have difficulty if rates rose just 0.5% (50 basis points). Households who are older, on average have more headroom. In the “more than 7%” category, 60% of households are over 40 years.

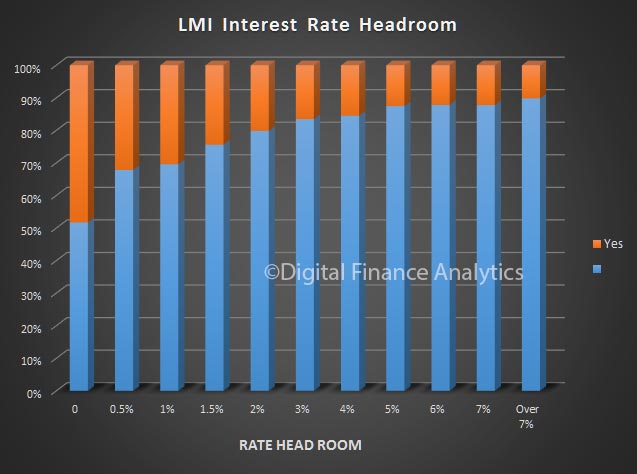

Another interesting cut is the penetration of Lenders Mortgage Insurance (LMI). Around half of households with an LMI protected loan (remember the LMI Insurance protects the BANK, not the Household) would have difficulty if rates rose bu 50 basis points. Households with no need for LMI (normally because they have a lower loan-to-value ratio) have more headroom.

Another interesting cut is the penetration of Lenders Mortgage Insurance (LMI). Around half of households with an LMI protected loan (remember the LMI Insurance protects the BANK, not the Household) would have difficulty if rates rose bu 50 basis points. Households with no need for LMI (normally because they have a lower loan-to-value ratio) have more headroom.

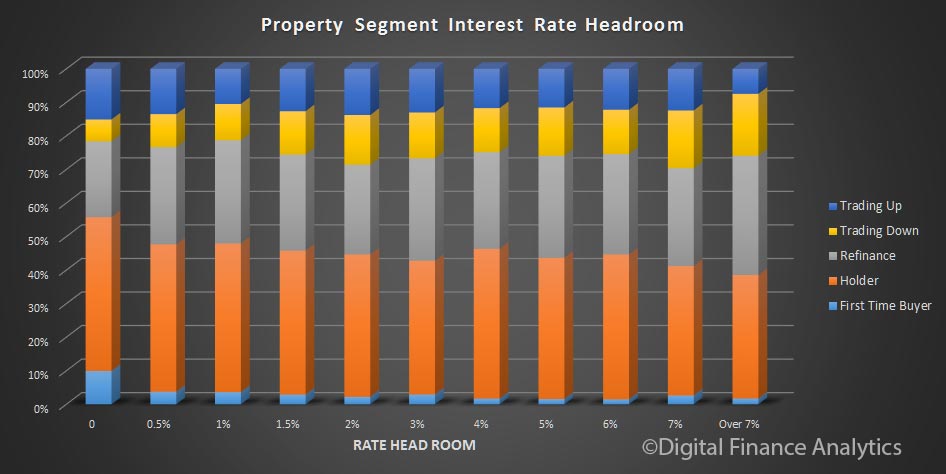

We see from our property segmentation that a greater proportion of first time buyers would be caught if rates rose 50 basis points, but property holders are the largest segment at the high end of the risk profile.

We see from our property segmentation that a greater proportion of first time buyers would be caught if rates rose 50 basis points, but property holders are the largest segment at the high end of the risk profile.

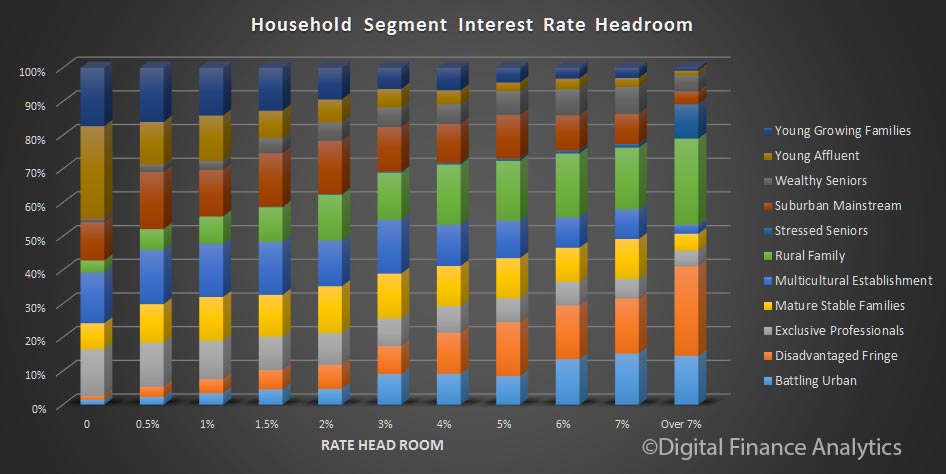

A look at our master segments shows that young growing families and young affluent households are relatively the most exposed if rates rise. Interestingly our battling urban, and disadvantaged fringe groups (who would generally be regarded as the worst credit risk) have more headroom. This is because they have smaller mortgages, so are less leveraged.

A look at our master segments shows that young growing families and young affluent households are relatively the most exposed if rates rise. Interestingly our battling urban, and disadvantaged fringe groups (who would generally be regarded as the worst credit risk) have more headroom. This is because they have smaller mortgages, so are less leveraged.

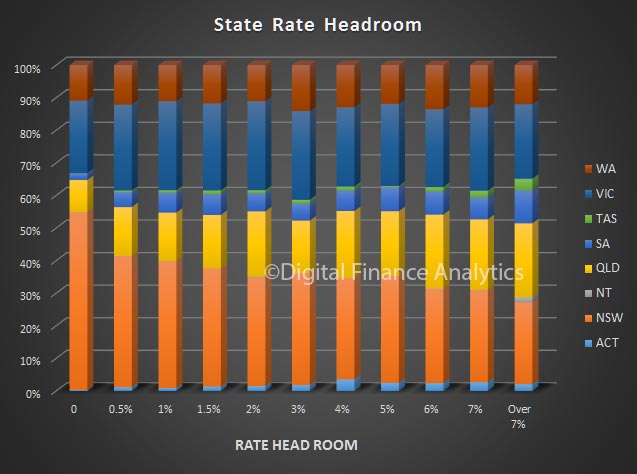

By state, NSW have the highest proportion of households which would be exposed by a 50 basis point rise – again because of large mortgages and high home prices. By comparison, households in QLD AND VIC have more headroom. Some households in WA are also exposed at 50 basis points.

By state, NSW have the highest proportion of households which would be exposed by a 50 basis point rise – again because of large mortgages and high home prices. By comparison, households in QLD AND VIC have more headroom. Some households in WA are also exposed at 50 basis points.

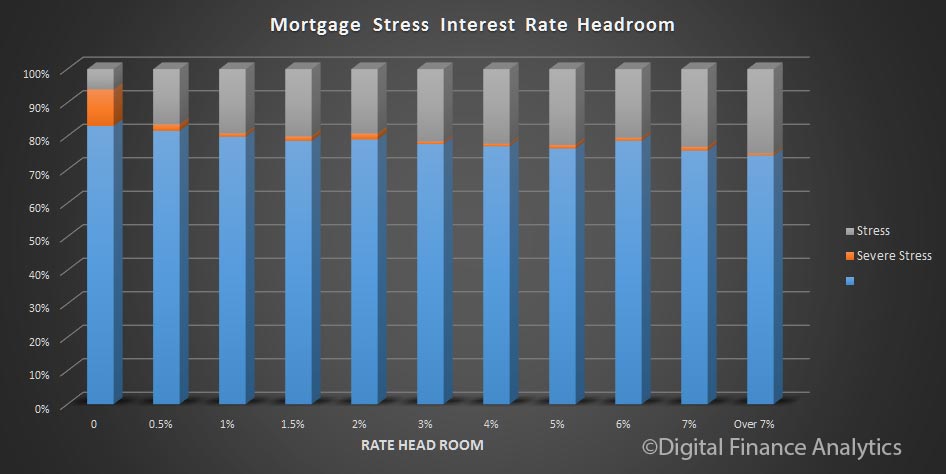

Finally, we also see that the majority of households we identified as in severe mortgage stress appear in the band who would be under pressure if rates rose just 50 basis points. This is a validation of our modelling, and shows the alignment between mortgage stress and rate movements.

Finally, we also see that the majority of households we identified as in severe mortgage stress appear in the band who would be under pressure if rates rose just 50 basis points. This is a validation of our modelling, and shows the alignment between mortgage stress and rate movements.

A further illustration of the power of effective segmentation!

A further illustration of the power of effective segmentation!